Palo Alto Networks (PANW) and FireEye are fierce competitors, especially when it comes to winning the hearts and minds of Wall Street. PANW is on Fire, even more so than FireEye. Twelve months ago, to the exact day, PANW stock was $41/share, and today its $108/share making PANW worth $8.6B. On March 5, 2014, FireEye stock closed at $95/share, and today its $32/share. FireEye is best known for “specialized threat analysis and protection technology” whose addressable market is 10 times smaller than the IPS market where PANW operates, which is estimated to be $1.9B. FireEye gets its, and the reason their acquiring companies left and right is to broaden their addressable market. (Note: I’m not a CFA or Financial Analyst of any kind so don’t rely on this data for investment decisions).

FireEye aims to be end-to-end, as does PANW. But in their world, end-to-end means from the endpoint to the data center. In the CDN world, end-to-end means just that, starting from the origin server in the data center to the browser. If FireEye wants to beat PANW, maybe acquiring a global infrastructure company like a CDN will enable them to be a true end-to-end security player, from endpoint in the corporate perimeter to the last mile. In addition, a global CDN broadens the FireEye security feature set. Why does this make sense? Here are a few trends taking place today.

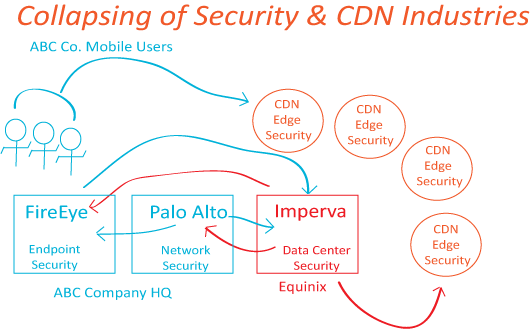

- Endpoint is no longer confined to the corporate perimeter, as mobile devices are now a big part of the corporate world

- 4 Pillars of Security: Endpoint, Network, Data Center and CDN Edge are collapsing

- Traditional security appliance functionality is making its way to the CDN edge

- CDNs offer scalable security solutions that scale on demand and can be deployed within minutes across the entire global POP infrastructure in many cases

- CDNs are starting to add features that defends against unknown malware

- Imperva is migrating from data center security to CDN edge, and to corporate perimeter security

- Palo Alto is expanding from the network to the endpoint

- FireEye is expanding to the data center and endpoint