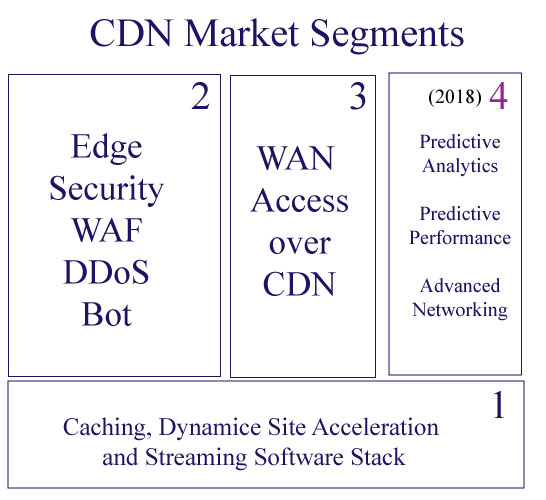

The CDN market share for 2017 is broken down below. Going forward, it’s going to be a little more challenging estimating market share due to converging business models and industries. Today, there are three clearly identifiable segments in the CDN industry: 1) Caching and Streaming 2) Edge Security and 3) WAN Access over CDN. By the end of next year, we expect the number of segments to increase to five, based on our research. Further below are the market share estimates for 2020.

2017 Market Share (revenue)

- Akamai: $2.5B

- ChinaNet Center: $600M~

- Limelight Networks: $200M

- ChinaCache: $151M

- AWS CloudFront + Level 3: $500M (does not include S3 revenue)

- Instart Logic + CloudFlare + Fastly + Incapsula + Aryaka: $700M

- Comcast + Google: $100M

- StackPath + Highwinds: $60M

- Pure play Transparent: PeerApp + Qwilt + Competitors: $500M

- Remaning CDNs: $250M

- Total: $5.5B~ (plus or minus a few hundred million)

From the total above, we expect $1B to come from Edge Security (CDN, WAF, DDoS and Bot Mitigation) services and $150M from WAN Access over CDN (Aryaka = $100M, Akamai = $30M, Cato = $20M). There are currently only three companies in the world providing WAN Access over CDN: Aryaka Networks, Akamai and Cato Networks (“AAC”). Although “AAC” provides different technologies that address similar problems associated with legacy MPLS, we believe all three different technology stacks will eventually converge in a few years.

“WAN Access over CDN” are the networking services that replace legacy MPLS

One of the important facts to point out – Edge Security and WAN Access over CDN revenues are not cannibalizing existing CDN sales, in that they are new revenue streams coming from other industries. Therefore, any CDN market share forecast models for 2020 must include market share metrics for the industries that are bearing the brunt of losses to Edge Security CDN. We’re going to develop some high level estimates here, with a lot of assumptions.

2020 Market Share

In 2016, IDC estimated that security appliance revenue was $11.6B with 2.7M units sold. The top five security appliance vendors are Cisco, Check Point, Palo Alto Networks, Fortinet and Blue Coat in that order. None of the five vendors provide Edge Security services, therefore, they will lose market share to CDNs. The competitive advantage Edge Security CDNs have over these vendors: 1) scales on demand across dozens of edge PoPs around the world 2) tightly integrated with content delivery services and 3) CDNs built highly distributed security architecture from the ground up on day one.

The question is what percentage will CDNs capture from the security appliance vendors. One way to divvy up the market is to categorize revenues into four silos: 1) corporate perimeter firewall 2) firewall for websites 3) firewalls for cloud applications and 4) firewalls for data centers where enterprise apps are located. Edge Security CDNs can do 3 of the 4. In our estimates, lets say the three silos represent 50% of total revenue, followed by 35% and 25%. Here is how it looks.

- $11.6B x 50% = $5.8B

- $11.6B x 35% = $4B

- $11.6B x 25% = $2.9B

Lets add the 9.7% annual growth for the next three years to the estimates above

- $5.8B x 9.7% x 3 Years = $7.66B

- $4B x 9.7% x 3 Years = $5.2B

- $2.9B x 9.7% x 3 Years = $3.8B

Next, lets say Edge Security CDNs capture 50% of the three silos from the security appliance market in 2020

- $7.66B x 50% = $3.8B

- $5.2B x 50% = $2.6B

- $3.8B x 50% = $1.9B

Now we’re going to take the total CDN market share for 2017 and subtract Edge Security, which gives us $4.5B. Now lets grow this number by 20% for the next three years.

- $4.5B x 20% x 3 Years = $7.8B

Finally, lets add CDN market share in 2020 to Edge Security revenue

- Low Estimate: $7.8B + $1.9B = $9.7B

- Mid Estimate: $7.8B + $2.6B = $10.4B

- High Estimate: $7.8B + $3.8B = $11.6BB

In summary, CDN market share for 2020 is estimated to be in the range of $9.7B to $11.6B range. We didn’t include WAN Access over CDN in the calculations because we believe this service will take off in 2020.

–Please note we are not financial analyst, so don’t use these figures for any investment decisions.