In a perfect CDN world, Akamai acquires Shape Security, and Limelight Networks (LLNW) takes a big step forward and acquires Lastline. If both events happen, the CDN industry landscape dramatically changes, and the entire CDN ecosystem is better off. Shape Security has raised $66M in funding, making an acquisition pricey, but with Akamai bordering an $11B valuation, and $1B war chest, its definitely affordable.

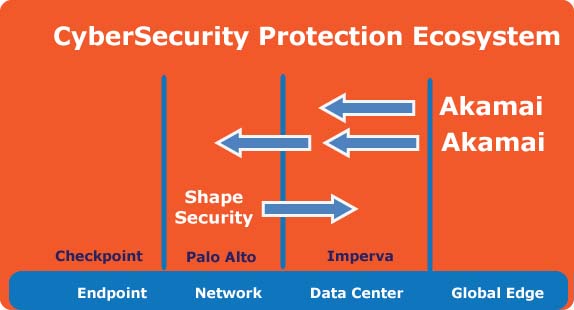

The question is “will Akamai extend its reach beyond the global edge, where it is the King of DDoS protection, further into the data center security tier, or even network security tier, and apply new pressure to the security ecosystem.”

Limelight Networks and Lastline

If there were ever two companies that were made for each other, that would be LLNW and Lastline. Limelight Networks, in a drive to get back its mojo, needs to jump out of their comfort zone, and acquire an affordable security company, bypassing many in the CDN ecosystem. Lastline, the FireEye like company, has raised $10M in funding, making it affordable for LLNW. Limelight can use part of its $100M in cash, and stock, to pay for the transaction.

What kind of impact would the acquisition have on LLNW’s stock, once they announced the acquisition? Their stock price would probably double from $2/share to $4/share. In 30 days time, it’s possible LLNW hits $1B in valuation, rewarding the Lastline team handsomely. Just mentioning the words LLNW and FireEye in the same sentence, will put LLNW on the map, with investors, and the competition.

Akamai, Shape Security and Lastline

Shape Security is the highly secretive cybersecurity company that has developed a next generation security appliance, that mask the login fields with gibberish text, confusing the bots as to where to enter the login information. The appliance is very website focused, making it a great fit for Akamai. However, If the Akamai’s cost/benefit evaluation is not in favor of a Shape Security acquisition, there is always Lastline.

If Akamai made an announcement that it’s acquiring a FireEye like competitor, it would have the same impact on their stock as it would with LLNW. Akamai could probably add $1B to $2B to its valuation. In case anyone hasn’t notice, the name FireEye is gold right now on Wall Street, and it carries a lot of weight.