It’s been fairly quiet in the land of Cloudfront and Internap. While AWS continues to push the envelope in the cloud computing game, it’s in cruise control when it comes to its CDN, along with Internap. As an outsider to the Amazon and Internap ecosystem, we bring fresh out-of-the-box perspective when assessing and analyzing their CDN business models. The first thing that come to mind with Cloudfront and Internap – maybe the reason their CDN is in cruise control is because 90%+ of their revenue is in cloud compute. And when the CDN business is a small percentage of the overall revenue, innovation suffers, since the pressures of the startup environment are not present.

Secondly, Amazon and Internap have yet to publish anything on their DDoS Mitigation strategies. Next year, DDoS Mitigation is going to be a commodity service that all CDNs have in their feature set. It just doesn’t make sense for an online customer to sign up with a CDN for content delivery services, and DDoS Mitigation services with another provider. It’s cumbersome, and hundreds of milliseconds are wasted when two separate providers are being used. Its better for the online customer to have CDN and DDoS services in the same data center, separated by racks instead of cities. Having a CDN POP in one city, and the DDoS Mitigation scrubbing center in another city is a waste of valuable milliseconds.

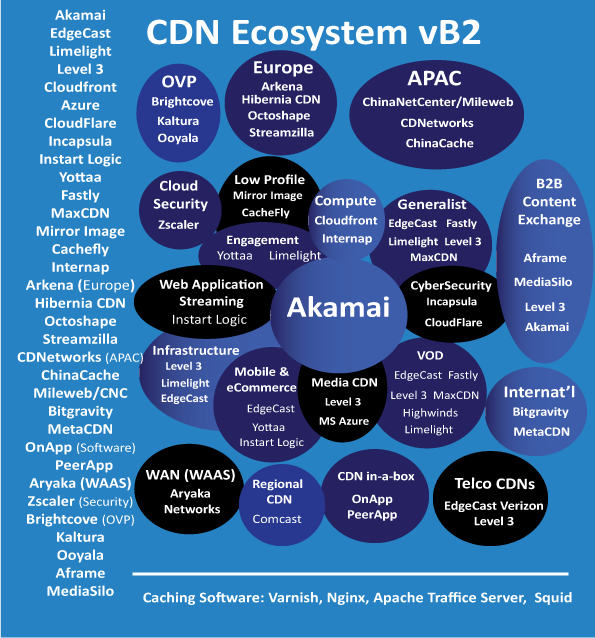

CDN Ecosystem Diagram vB2

On another topic, here is the latest update to the CDN Ecosystem Diagram. The updates include the following:

- Added an area for Cloudfront and Internap called Compute

- Added an area called B2B Content Exchange

- Added Aframe, MediaSilo, Level 3 and Akamai to the B2B Content Exchange area

- Added the major CDN caching software platforms

- Added and area called International CDN for India-based Bitgravity and Australian CDN MetaCDN