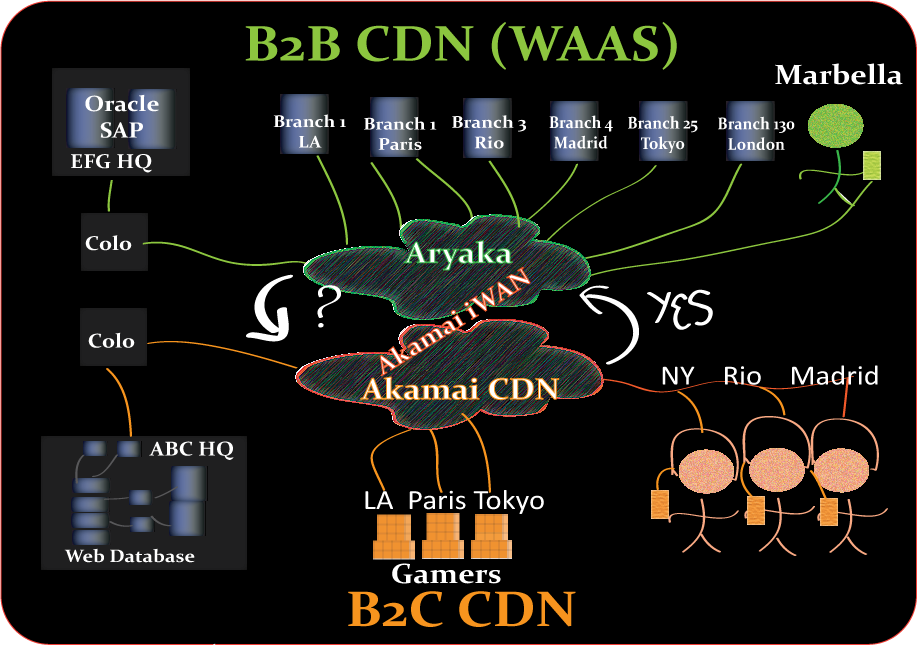

The arrival of Aryaka Networks split the CDN industry into two separate business models: B2B WAAS (WAN as-a-service) and B2C CDN. Both business models use similar POP architecture and infrastructure, however, both are completely different, satisfying the needs of different target markets. The B2B WAAS providers help with the delivery and security of back office business applications. The B2C CDN providers help with the delivery of content to the consumer market. Fortunately for Aryaka, “they are the B2B WAAS market”, dominating that segment for the last few years. Today there isn’t really a #2 enterprise WAAS provider that threatens Aryaka. However, I’m sure there will be at least one viable competitor in 12-16 months, being that Akamai/Cisco have just entered the B2B WAAS market.

Aryaka is hardware agnostic, and works with any hardware. Akamai is dependent on Cisco hardware for its WAAS offering. The Cisco dependency is good for Akamai, but only in one case, and that’s if Cisco brings a ton of business to Akamai. If not, than Akamai needs to develop a hardware agnostic WAAS offering, since the foundation of SDN and the Cloud is being hardware agnostic. Below is a diagram that visualizes both business models.

B2B WAAS and B2C CDN Ecosystem Diagram v1

According to Frank Childs, Product Manager at Akamai, the Akamai/Cisco iWAN (B2B WAAS) solution has received “a high level of interest” from companies. Althought Akamai has 1 to a handful of iWAN customers, Aryaka has a 5+ year’s head start and hundreds of customers. The Akamai/Cisco iWAN product is a combination of CDN, WAN, and VPN running over Cisco routers. In another words, it’s a B2B CDN. Akamai/Cisco have a ways to go in order to catch up to the Aryaka, the billion dollar (valuation) WAAS leader. Aryaka has the first mover advantage, and is likely to stay dominant for many years. The reason is because they are leveraging the first-hand experience they gained in building, operating and growing a global CDN by the name of Speedera Networks. Having a CDN background and expertise is key to building an enterprise WAAS offering. In a way, the Speedera experience made Aryaka possible. Any company wanting to get into WAAS business without having deep CDN expertise is going to find it very challenging. The question I have, since Akamai is now gunning for Aryaka, will Aryaka respond and offer CDN services to its customer base. That will be discussed in another post.