One could say we are in the golden era of content delivery networks, where the traditional CDN business model is giving way to new CDN business models. The entire CDN industry of today is much different than the one in the past, because of three major trends: 1) Arrival of new Internet companies like Snapchat, Imgur, Twitter, etc 2) Advancement of the open source software ecosystem and 3) Decrease in hardware cost. All three trends not only made it possible to start a CDN at a lower price point, but the arrival of social media companies have expanded the market opportunity for CDNs by orders of magnitude. How much? Its difficult to say now as we are barley entering into this new phase.

Explosion of the CDN Market

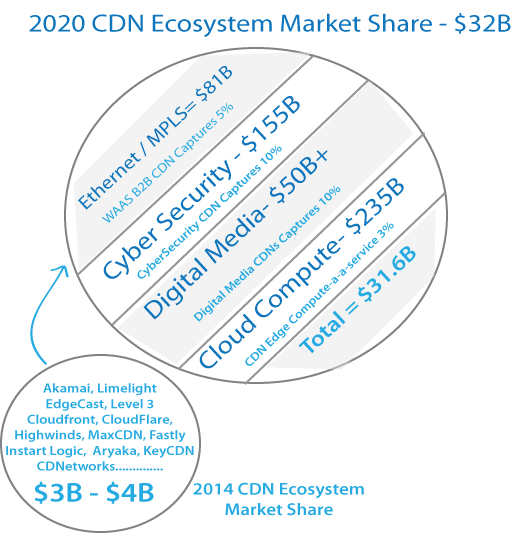

According to one of my recent estimates the current CDN market is about $3B. To be safe, let’s say its $5B. In the grand scheme of things the CDN market is still small compared to other sectors. Akamai is the leader in the CDN industry, but a pup in other sectors. This year is important because it marks the birth of the fourth generation CDNs. The 4th CDN is different today not only because of their innovative feature sets, but because they are expanding outside the CDN industry into other technology sectors that are much bigger. CDNs must now pick their poison, if you will, and decide in which vertical they want to compete in, because there are much bigger markets out there, and bigger fish to fry than Akamai. How much bigger? If we do some rough calculations, maybe $32B

CDNs Disrupting Other Sectors

- Aryaka Networks => MPLS Market

- CloudFlare, Incapsula, Akamai, EdgeCast => manufactures of security hardware

- MediaSilo and Aframe => Deluxe, Technicolor, Adobe, & others

Out with the old and in with the new

Is CloudFlare worth $1B? Maybe it’s worth $2B, and we just don’t know it yet. The past perception around CDNs are no longer relevant today. One example is valuation. The valuation methodologies of the past, in which CDNs were acquired for a certain dollar value, based on top line revenue, bottom line, or feature set capability are not as clear cut. When businesses like WhatsApp sell for $19B, or new publicly traded pure-play security companies are valued in the billions of dollars when revenues are barely exceeding $100M means we are in different times, and investors are having a difficult time understanding the current market. EdgeCast is probably going to be the last CDN that acquired based on definable valuation methodology.

Links to Market Share Estimates