Once upon a time, Europe was a wide open market for US based CDNs, because the competition was non-existent. Akamai, Level 3, Limelight, and many other CDNs thrived in the European market, signing up hundreds of customers across the UK, France, Germany, and all neighboring countries. Then Telefonica and Deutsche Telekom entered the picture, and started reselling CDN services. Over time, the two large telecom giants started building parts of their CDN ecosystem internally, becoming hybrid CDNs. In 2014, the competitive landscape changed dramatically, as new CDNs entered the market, bringing along with them new CDN business models.

Times have changed. US based CDNs must not only compete against each other for European customers, but they must now contend with European CDNs. Over the next three years, the European CDN competition will intensify, as these new CDNs expand their feature sets, grow their sales teams, and expand operations. Many of these European CDNs are now serving hundreds of Gbps of CDN traffic individually. Its not rocket science, in that European CDNs will follow the same strategy that US based CDNs have mastered; grow in local markets (Europe in this case), then expand globally.

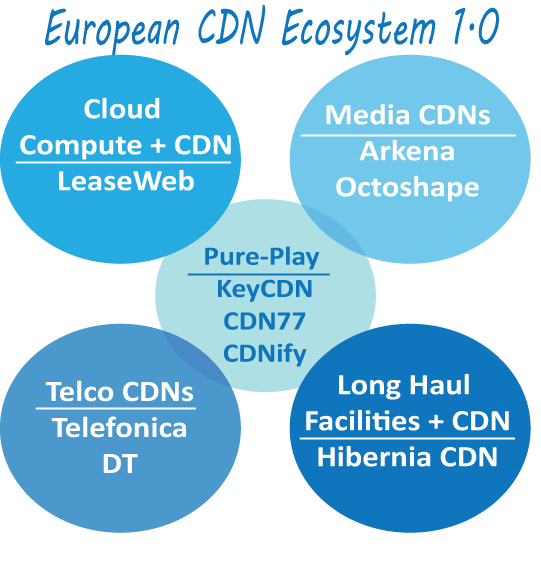

European CDN to US CDN Similarities

- Cloud Compute CDN: Cloudfront and LeaseWeb

- Media CDN: Level 3 and Arkena

- Pure-play CDN: MaxCDN and CDN77 + CDNify + KeyCDN

- Telco CDN: AT&T and Telefonica

- Long Haul Carriers (Facilities based): Level 3 and Hibernia