The CDN market is “NOT” a $4 billion market, but a $40 billion market. When analyst determine the market size of any sector, it all boils down to the definition of the sector, and if the definition is off, then so are the estimates. Some specific areas in the CDN Ecosystem are highly commoditized like eCommerce acceleration, streaming, caching, website acceleration, basic DDoS mitigation, and so on. However, there are other markets that are 10x to 20x bigger than the CDN market, but in which CDNs are playing in today. Many of today’s market researchers exclude this vital statistic in the estimates. Some CDNs have recognized this vast opportunity, and have started to pivot their business models to accommodate.

Also, did anyone ever consider that incumbent carriers like Telefonica, Orange, China Telecom, or whomever, are actually CDNs in their respective country, whether they think so or not. These last mile carriers are not a pure-play CDN, but a regional CDN that was created for the sole purpose of delivering video to their last mile customers, via a watered downed version of a CDN implementation. The Network Operator sector is the new frontier for CDNs. This market is gigantic because when they invest in their network, they invest hundreds of millions of dollars, and then some.

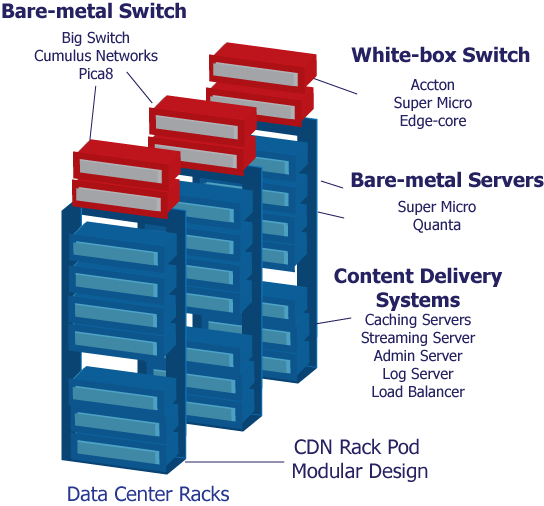

The bare-metal hardware + SDN + NFV + CDN is going to turn the CDN industry into the wild wild west, and whoever figures it will embrace vast fortunes. If Akamai, or any other CDN wins a small percentage of this market, they might possibly see hundreds of millions of dollars in new business. Is there any data to back this up? Of course not, because this trend is not even on the radar of most. One way to think of Bare-metal CDN in the Network Operator market is by this illustration.