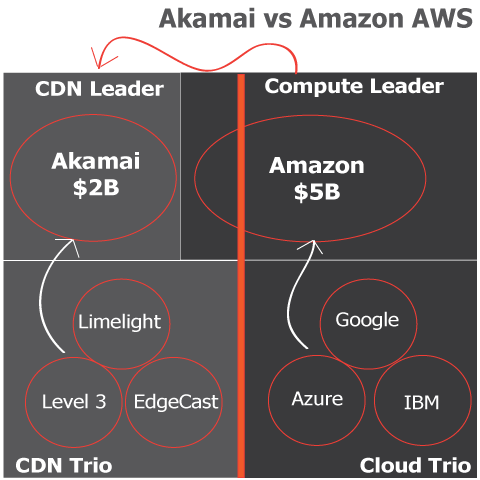

Akamai and Amazon are similar in a few ways. Akamai dominates the CDN industry with about 53% market share. Amazon Web Services dominates the cloud industry with 30% market share. Each has three fierce competitors. Also, Akamai has a CDN that is orders of magnitude better than Amazon CloudFront, but Amazon has the leading cloud platform and Akamai has none.

Akamai vs Amazon Web Services

- Akamai: 53% CDN Market Share. $2B Annual Revenue. Main Competitors are Level 3, EdgeCast and Limelight Networks

- AWS: 30% Market Share. $5B Annual Revenue. Main competitors are Google Cloud, Azure and IBM SoftLayer

Akamai and Amazon are also different in a few ways, especially when it comes to risk taking. Amazon loves to take risk in doing new things, and bets the house on it. Akamai’s modus operandi is to play it safe, especially when it comes to acquisitions. The Proloxic acquisition was a conservative play, since Akamai already had a streamlined DDoS Mitigation service in place. However, Amazon would like nothing better than to take market share away from Akamai.

Akamai Neutralizes AWS Threat

Although Amazon will have a difficult time winning clients away from Akamai directly, they can do it indirectly through AWS. When companies sign up for AWS, the CloudFront product is a few clicks away. So as long as Amazon continues to grow its AWS business, it will sign up more CDN customers by default. Yes, a big chunk of the CloudFront clients bill less than $1k/month, but AWS does have some decent billers like encoding.com, Aframe.com, Signiant, and others. What can Akamai do to counter the AWS threat? Buy an innovative start-up in the cloud compute space, and offer cloud compute solutions to their enterprise customers.

How would it work if Akamai were to buy a small Rackspace? The compute infrastructure would run in the same data centers that houses the CDN infrastructure. Akamai could offer VMs and compute instances on-demand to CDN customers who are in need of compute capacity for special events like the Olympics, Oscars, and Grammys. Not only do these customers need CDN services, but also vast amounts of compute resources. So why does Akamai turn its back on low hanging fruit and give it to AWS. The Akamai compute at the edge would be a tremendous hit that is likely to generate tens of millions of dollars in business annually. But the chances of that happening are slim to none, but maybe Akamia has something under its sleeve.