It’s looks like the the recent ruling on Net Neutrality is starting to move the needle in favor of the Middle-mile Middlemen, kinda, sorta. There are some winners and losers in this soap opera, but it will take some time to figure things out. Yesterday, “Level 3 and AT&T entered an into interconnection agreement” which “will result in improved efficiency of traffic exchange” between the two carriers. Is this a result of Net Neutrality? Absolutely. Does the interconnection agreement have any positive financial impact to Level 3? We shall find out below. Net Neutrality and Peering are usually totally separate conversations, but in this case, Net Neutrality influenced two parties to expand on a current peering arrangement. Before we continue, let’s get into the Tier 1 Network mindset. Back in 2008, Renesys published a piece called Peering Wars. The four key takeaways are as follows:

- “Tier 1 Networks connects with others via Settlement Free Interconnection”

- “Near” Tier 1 providers try to buy their way in via paid peering if they can’t get a Settlement Free Interconnect

- “Tier 1 providers act like a cartel and have no incentive to add members”

- “Paid peering cannot be distinguished from Settlement free peering”

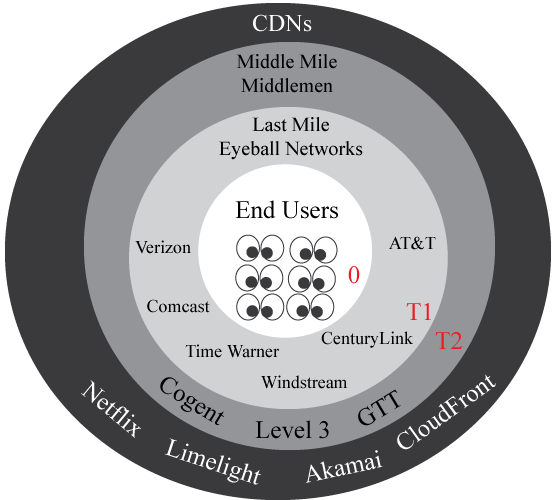

Approximately one year ago, Mark Taylor, a visionary executive from Level 3 published a piece on their peering structure. Mark stated that there are two broad categories of Peers, the middlemen like Level 3, and the consumer broadband company like AT&T. The Tier 1 consumer broadband companies are usually local incumbents in their respective region, but also have a global network presence like Telefonica and BT. This elite group of carriers owns the last mile, therefore, the middlemen must pay for access in many parts of the world. Here are some takeaways from Mark Taylor insight piece:

- Level 3 has tens of thousands of customers

- Level 3 has only 51 Peers that “enables customers to see the whole Internet”

- 48 of the 51 peers are settlement free

- Level 3 policy is to “refuse to pay arbitrary charges to add interconnection capacity”

- Two broad categories of peering: 1) peering with middlemen like Cogent 2) broadband consumer networks like AT&T, Verizon, Orange, TATA, BT, and DT

- Level 3 interconnection capacity exceeds 13.6Tbps: 1,360 x 10Gbps ports

- Average utilization is 36%

- Average utilization 36% x 13.6Tbps = 4.9Tbps of sustained traffic

- 12 of the 51 peers have congested ports

- Some of the congested ports are at 90% utilization resulting in dropped packets and lower QoS

- 6 of the 12 congested peers are broadband providers that refuse to augment capacity

- 5 of those congest peers are in the US and 1 in Europe

Next, lets take into account Level 3’s financials. In Q1 2015, Level 3 reported $2B in revenue, and Network Access Cost of $723M. Level 3 defines Network Access Cost as “leased capacity, right-of-way costs, access charges, satellite transponder lease costs and other third party costs directly attributable to providing access to customer locations from the Level 3 network”. In a nutshell, Level 3 paid hundreds of millions of dollars to the likes of AT&T, Verizon, etc., for local loop fees, and other access fees, since they don’t own the last mile.

Now lets do some math. In 2014, Level 3 sustained capacity was around 5Tbps (13.6Tbps x 36% average utilization – give or take 1Tbps). Lets take 5Tbps x $1/Mbps = $5M/month or $15M/quarter. The $1/Mbps is an extremely high number used for example purposes, since Level 3 doesn’t pay for the majority of their peering. If we then compare $15M/quarter paid for peering to the $723M/quarter paid in access cost, there is minimal impact to Level 3’s financials.