Palo Alto Networks (PAN) has come a long way over the last year. Today, PAN is almost as valuable as Juniper + Fortinet combined, or more valuable than Fortinet + FireEye combined. In the Quarter- ending April 2015, PAN recorded $234M in sales. On top of that, PAN continues to acquire companies, such as CirroSecure to round out its security portfolio. CirroSecure helps PAN secure SaaS applications, such as Salesforce, Dropbox, and so on, in the cloud. PAN sees the cloud as an important part of its future, and they’re trying to figure out the right business model, because onsite appliances is the antithesis of the cloud.

The long term trend doesn’t shed a positive light on the security appliance in five years. We all know that all compute, storage and delivery is going to the cloud, whether its public or private. The same is happening to security. This raises an interesting question; does the PAN App-ID feature provide as much benefit to companies hosting applications in the cloud, as it does to those companies hosting applications behind the firewall in corporate networks? Maybe. Lets dig a little deeper into the PAN cloud offering; PAN offers VM-300 Next-Gen Firewall on AWS for $.96/hour or $3,370/year.

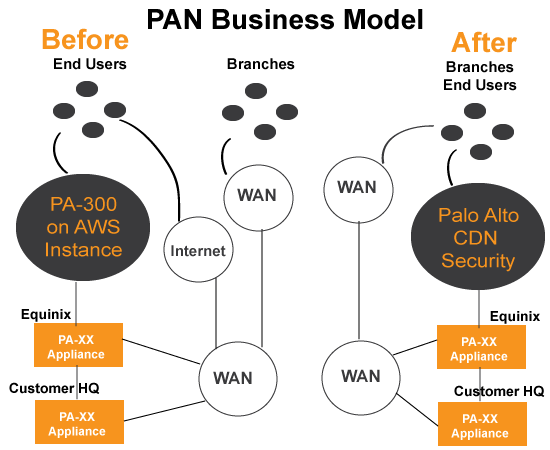

In addition, Amazon adds its EC2 fees of $.882/hour or $635/month or ~$7600/year; the total package price is ~$10k/year. The VM-300 comes packed with IPS, Anti-virus, Malware Prevention, URL Filtering, premium support, and 1Gbps Firewall Throughput. The VM-300 on AWS is PAN’s version of cloud security, but the biggest drawback, it can only be in one place at one time, and on-demand scalability is non- existent beyond the 1Gbps. Anything more requires the spin up of another instance. In order to overcome this limitation, why wouldn’t PAN build or acquire a CDN to enhance its cloud security offering? They would be incredibly dangerous if they did.

Palo Alto Networks CDN Edge Security Suite

PAN could deploy a true cloud security solution that can be everywhere at one time, and scale on-demand within seconds. In addition, PAN could address the one limitation that Zscaler has – it can offer caching services alongside cloud security. Securing and content acceleration go hand-in-hand. And it wouldn’t be out of the ordinary if PAN bought a CDN.

After all, Fortinet bought a start-up CDN back in January 2013, when they acquired XDN Inc. At the time of the acquisition, John Maddison, VP of Technical Marketing for Fortinet mentioned that “Fortinet saw a chance to beef up its software abilities in cloud management” and that a “hybrid model for security is emerging” that combines appliance + cloud. Fortinet did eventually discard the CDN infrastructure, but today the market is much different, as the CDN and Cloud Security markets collapse into each other.

Disclosure: I’m not a Financial Analyst, and I’m not qualified to give investment advice on any stocks, or anything else.