The SD-WAN niche is exploding, as a ton of startups enter the market with their own flavor of services. It some respects, its similar to the disruptions occurring in the CDN market, as startups such as Twin Prime push the envelop. Although relatively new, SD-WAN startups are in the process of building out their own ecosystem, as investors pour money into this hot sector. According to Gartner, there was 5,000 branches deployed globally in 2Q15 under the SD-WAN umbrella. SD-WAN is different than SDN, because SD-WANs don’t require the “decoupling of forward and control planes“.

SD-WAN companies aim to solve the problems associated with expensive and inflexible carrier centric solutions like MPLS. The promise of SD-WAN is to reduce cost, avoid vendor lock-in, improve provisioning times, increase global coverage, and ease manageability. The exciting part is that SD-WANs and B2B CDNs are starting to collide into each other, as their services start to overlap. Let’s break things down for the sake of clarity.

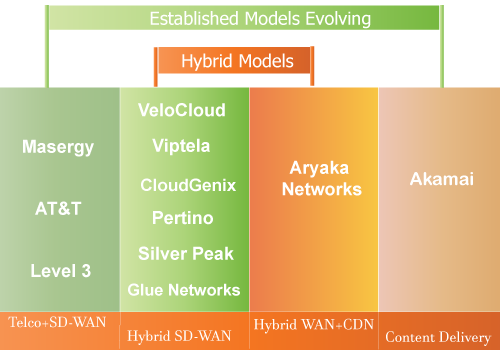

- Traditional Carriers: AT&Ts of the world provide old school services like MPLS and VPLS

- Innovative Carriers: Masergy’s of the world are smaller and therefore more proactive in deploying the latest and greatest technologies

- Software SDN Startups: Startups like CloudGenix have no network or sell no hardware, but provide software solutions to alleviate the problems associated with carrier centric data services

- Security WAN: Zscaler is a kind of a WAN company, because they act an outer protective ring to the Internet for clients, and enforce control over middle mile traffic

- Hybrid CDNs: The Aryaka’s of the world offer a hybrid WAN solution coupled with B2B CDN services

**Only a few SD-WAN startups are noted above