When it comes to services and features, some are commodities, such as video streaming, while others have the potential to be huge market disruptors. Video streaming is a fiercely competitive market that’s become a penny business, much like the supermarket industry. Volume is the name of the game, and if a startup doesn’t stream in significant volume, then sales and profits suffer.

It’s no secret that when it comes to high volume streaming, price/GB tends to race towards zero, especially with so many competitors providing the same service. Because of this, many companies try hard to provide a suite of features to go along with streaming, so that they can lift the price/GB across the board.

And then we have the caching part of the business. Although caching is not in the same predicament as streaming, it’s slowly headed in that direction. Again, no surprises there. That leads to the question, what products or services are at the opposite end of the streaming spectrum with higher profit potential? The answer lies in the the CDN Value Chain.

CDN Value Chain

Access the whole market insight?

Get full access to this research brief for $59.00. Or sign up for our monthly membership and have full access to all the market insight research briefs. Thanks for your support.

Buy Now

[MM_Member_Decision membershipId=’5|7|9|11|12|13|14|16|18|22|26′]

CDN Value Chain

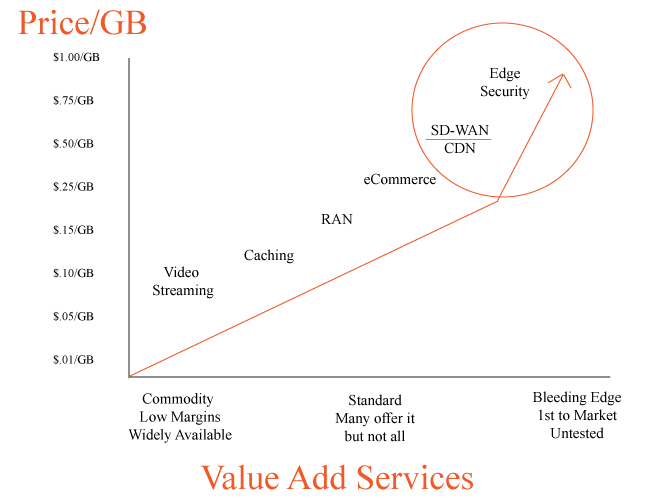

The CDN Value Chain is the set of value added services that CDNs provide online companies. These services range from basic streaming and caching, to the more sophisticated, such as mitigating advanced cyber threats with machine intelligence and cloud-based SD-WAN. In order to quantify the value of a service, which proves exceedingly difficult to do, we developed the CDN Value Chain. What it does is illustrate the value of a service/s and correlates them to a price/GB. Because there are dozens of possible variations that impact price, the price/GB is not an exact figure, but we still have the research and information to estimate the service from a high level point of view.

The diagram plots the price/GB on the vertical axis and the type of value added service on the horizontal axis. The closer the price is to zero, the more the service is a commodity. We have identified six value added services based on our research efforts.

Value Added Services

- Streaming

- Big Event Live Streaming

- Small Event Live Streaming

- Caching

- Basic: VOD, images, small files, etc

- Advanced: Instant purge, SPDY, HTTP/s, etc

- Mobile SDK

- eCommerce

- Fortune 500

- Mid-market

- SD-WAN on CDN

- Edge Security

Streaming

Streaming is the single most commoditized service in every CDN portfolio. Cloud encoding / transcoding falls within the streaming umbrella. Although the end-to-end process video streaming from ingest to consumption is complex and challenging, the number of companies offering this service is in the dozens. Price is usually one of the main driving forces. For startups, streaming may be a feature that drives incremental revenue, but nothing more. Once a CDN reaches a global massive scale, then it becomes just a little more profitable.

Takeaway: Price/GB for VOD delivery and live streaming is in the sub-penny range for high volume monthly commits. High volume would be in the PB’s/month. And in some cases, penny pricing is available for half a petabyte. With these numbers, it’s a really hard business to profit from, which is why many startups have chosen to avoid it altogether.

Caching Services

In the past, caching meant the storing and delivery of static content. Then Dynamic Site Acceleration came to market, and optimized the performance of non-cacheable content over the middle mile. Thereafter, instant purge was developed and forced the entire industry to update their caching architectures to support this cool new feature that took the market by storm. Finally, SPDY, HTTP/2 and QUIC arrived and the industry started moving forward on support for these protocols, even though it involved a lot of work and proved quite costly.

Takeaway: How much should a company charge for Instant Purge? Or what should they charge for being QUIC enabled? The simple answer is nothing, because these are backend features that all CDNs must support, just like they support HLS and HDS. It’s difficult to attach a price tag to these features, however, enabling QUIC or supporting instant purge is a major differentiator for the overall business model and CDN platform. It strengthens the value proposition of the CDN platform, which helps in competitive bidding situations.

RAN Optimization / Mobile SDK

The RAN + SDK service recently came to market about twelve months ago when a few players entered the market offering this new service and message. Many believe that providing RAN Optimization and Mobile SDK is a viable business model, which it very well may be, just not for the CDN industry. RAN optimization and Mobile SDK are CDN features that, at their best, enhance the overall value of the CDN platform.

Takeaway: Charging for mobile SDK is difficult for a CDN because it is a backend feature like HTTP/2, QUIC or HLS. Instead, this service is a part of the overall platform. RAN based optimization enhances the value CDNs provide their clients, and does help companies differentiate themselves from the competition.

Ecommerce

Ecommerce is listed as a service because not all CDNs have developed the full suite of services to address the needs of that segment. The full ecommerce suite includes PCI-Level 1 compliant network, DSA, FEO, WAF, Origin Protection, Instant Purge, Advanced Reporting, and Mobile Optimization. Some even go as far as creating a separate infrastructure (clusters) to handle SSL/Secured traffic, although that’s not a requirement.

Takeaway: Ecommerce is a great business, and profit margins remain high. The only difficult part of serving this niche is the fact that startups need to develop an expensive feature portfolio that costs millions. Just becoming Level-1 PCI compliant can cost a million plus, DDoS Mitigation and others cost just as much, if not more. Regardless, more and more CDNs have been developing their feature sets to build this business.

SD-WAN over CDN

SD-WAN is one of the fastest growing segments within the industry, and yet, there are very few companies competing in this sector. The reason – it’s incredibly difficult to develop these features, even for the CDNs. To date, there are two serious players in this niche who are startups. There is actually a third company, but their service is more of an afterthought, and they likely have fewer than five clients. The startups are challenging the legacy WAN market and WAN Security by bringing in a fresh new approach to WAN with cloud-based technologies. Their solution is not about appliances and hardware, but about solving the problems using cloud infrastructure, specifically CDN infrastructure.

Takeaway: Pricing and margins are high because these companies can base their price on the traditional WAN and Security pricing model. And the pricing model for hardware approaches is expensive, so even if WAN startups offer a 50% markdown, it still results in high profit margins that are 5x+ than what CDNs make selling their products.

Edge Security

Edge security is the most promising area for every company in the industry. In two short years the security feature set has exploded as startups introduce new business models and functionality that’s never been a part of the CDN mindset, let alone product portfolio. CDN and Cloud Security have converged, as founders from the security industry enter the space, bringing with them a fresh way of solving the latest problems with sophisticated features. In fact, the basic feature sets of DDoS Mitigation and WAF has gone through a transformation as outlined below.

Takeaway: There is no standard for pricing in the CDN industry, instead new pricing models are developing that incorporate prices from the traditional security sector. For example, instead of paying $50k for a NG-Firewall, startups can offer more competitive pricing for a cloud based NG-Firewall that not only was built for cloud applications, but scales more efficiently on demand.

Periods of Product Innovation:

- CDN + DDoS Mitigation

- CDN + DDoS Mitigation + WAF

- CDN + DDoS Mitigation + WAF + Bot Mitigation

- CDN + DDoS Mitigation + WAF + Bot Mitigation + Content Filtering + Mobile Device Security + HTTPS Inspection + Email Filter + Social Media Control + NGFW + Behavioral Fingerprinting

[/MM_Member_Decision]