Akamai and CloudFlare are giants in the DDoS Mitigation and WAF space. A few years back, Akamai was all about selling services to the large enterprise only and CloudFlare to the SME/SMB. Times have changed and Akamai is going downstream market and CloudFlare upstream.

From a revenue perspective, Akamai is the clear cut leader generating $254M in “Cloud Security Solutions” in 2015. Last year, CloudFlare CEO publicly stated that they were on a annual run-rate of $100M. If we add some growth to the number, its possible CloudFlare is on a annual run-rate of $125M – $150M range, and if they aren’t, that would be a shame. Based on these data points, CloudFlare is doing very well considering Akamai is a $9B company. Can CloudFlare catch up or even surpass Akamai’s annual revenue? It’s a possibility. For CloudFlare, all it takes is a small percentage of their 2M customers to upgrade their services to more expensive plans, and history will be made. Annual Revenue Grade: Akamai = 5 Stars and CloudFlare = 3 Stars

Functionality: Akamai and CloudFlare have battle tested DDoS Mitigation platforms, able to withstand massive network layer attacks, and application layer attacks. On the WAF side of the business, both are established web application firewalls that are constantly being updated and improved on. Akamai has more enterprise customers but CloudFlare dominates the SMB/SME and mid-market in terms of volume of customers. Maturity of DDoS + WAF Grade: Akamai = 5 Stars and CloudFlare = 4 Stars

Feature Set Innovation: Although CloudFlare continues to improve its platform with constant updates, and also rolls out new features every once in a while, Akamai is the clear cut leader, especially after having acquired Bloxx. Bloxx provides Akamai with a vast number of new security features. Whether Akamai is successful in re-packaging those for the “Intelligent Platform” is another story. Innovation Grade: Akamai = 5 Stars and CloudFlare = 3 Stars

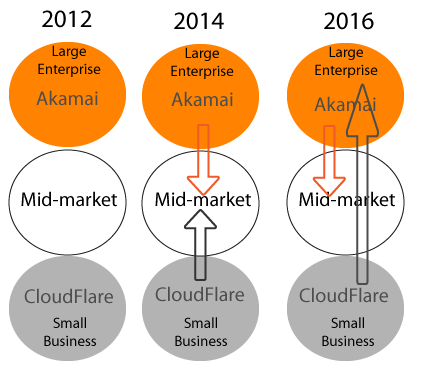

Target Market: Akamai dominates the large enterprise, protecting the biggest brand names in the world. When adversaries know companies are using Akamai, they think twice about wasting money. CloudFlare dominates the SMB/SME space. Once again, adversaries think twice about attacking CloudFlare customers because it would be a waste of valuable currency. Akamai shifted its strategy a while back and is now targeting the mid-market like there’s no tomorrow. However, Akamai will never come downstream to the SME/SMB market. CloudFlare started in the SME/SMB space, then went upstream to the mid-market, and now they’ve gone higher up the food chain to the large enterprise. Revenue Growth Potential Grade: CloudFlare = 5 Stars and Akamai = 4 Stars