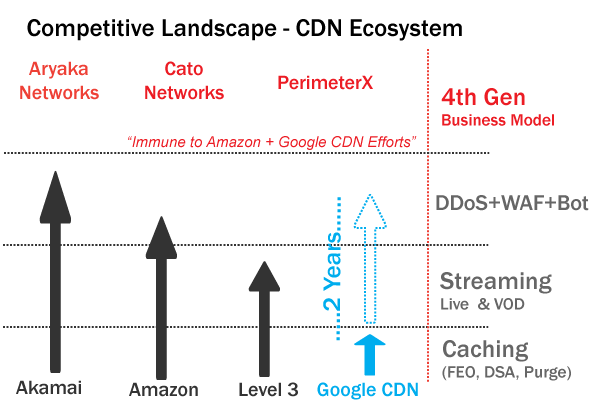

The competitive landscape has shifted significantly in the last week with the introduction of Google CDN. The severity of the threat that Google CDN poses to Akamai and some Pure-play CDNs is of nightmare proportions. In this brief, we’ll discuss what it means to the industry and the fallout that is to occur in the next twenty four months.

First, lets set the record straight. Google is not a friend to the CDN Pure-play, regardless if one can direct connect (“Cloud Interconnect”) to them. Their aim is to build an Amazon + Netflix like relationship with CDNs – a one sided relationship where Netflix can’t survive without Amazon, but Amazon can survive without Netflix. Next, Google’s entry into the CDN market is going to be twice as disruptive as Amazon CloudFront.

Not only will Google CDN catch up to CloudFront in two years, but they will surpass them in feature-set innovation and performance. After all, Google is a powerhouse inventor and/or enforcer of next-gen protocols – SPDY, QUIC, HTTP/2, etc. In fact, Google can and will develop features like DSA, FEO, and Twin Prime Mobile RAN Optimization and give them away for free just to gain market share.

Google To Become Full Scale CDN

Although Google CDN works only from Compute Engine (VM) for the time being, expect them to change their strategy so they become a full scale CDN, where they will be able to deliver content for AWS customers. For Google, there is nothing more exciting than stealing customers away from Amazon. And there is nothing technically challenging for Google to change strategy, and offer content delivery to non-Google Compute clients. In two years, there will be a major re-alignment in the CDN industry, and a dozen CDNs will exit the business once and for all, because Google CDN and Amazon CloudFront will destroy the profit margins of the caching and streaming market.

2 Year Window For The CDN

CDNs have two years to transform their business model, shifting their focus away from only “caching and streaming” to more innovative services. That means 3 months to decide on what new features to develop today, and another 3-6 months to roll them out. The new service must be immune to the price drops that are coming to market, courtesy of Google CDN and CloudFront price wars. The good news, there are a few startups emerging that are immune to the actions of Google and Amazon. The bad news, its already too late for some CDNs.

Sub-Penny/GB Pricing for Small/Large Object Delivery and Video Streaming

Expect prices for caching to hit $.01/GB for Large Object + VOD delivery and $.02/GB for Small Object + Live Streaming in a few quarters for small data transfer volumes. And it won’t stop there. Google’s main competitor is Amazon, not Akamai. And Google will get into a price war with Amazon CloudFront, as it does in compute and storage. The Google CDN + Amazon CloudFront rivalry will bring about the era of the “Sub-penny/GB Content Delivery” service. Now how many CDNs can survive on the sub-penny/GB pricing model? Not many.

Lastly, its only a matter of time before Google CDN gets int the streaming business. And when they do, it will be as good as CloudFront and cheaper than CloudFront. The Youtube ecosystem has provided Google with the tools and experience to scale video streaming to the masses at a very low cot structure. With the competitive landscape changing in twenty four months, how will CDN executives respond today to the dual-threat of Google CDN + CloudFront, as they bring about the massive commoditization of caching and video streaming prices.