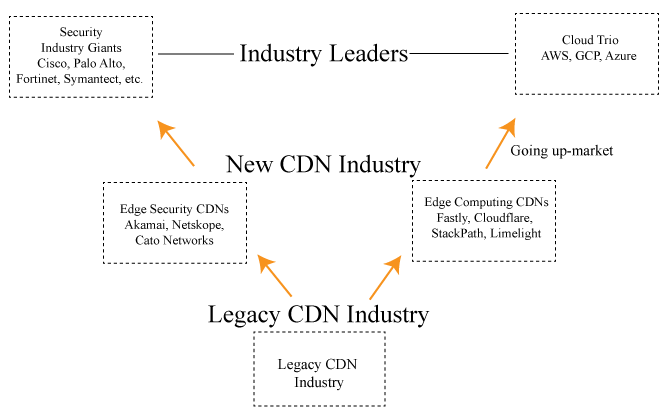

Tomorrow Fastly will go public breaking a 12-year dry spell for a CDN IPO. Limelight Networks went public in June 2007, nearly 1 year after AWS officially launched with S3, SQS, and EC2 in March 2006. The good news for Fastly, it will IPO at the most important juncture in CDN history, the era of edge computing. The CDN industry is in a major transition today and it’s shrinking from 4 segments to 2. The reason for the change – intense competition, price deceleration for basic services, and product innovation.

Industry Segment Reduction

- CDN services (commodity): small file + large file delivery, DSA, instant purge, streaming logs, SSL, origin storage, etc.

- Video (commodity): live + VOD delivery, transcoding/encoding, HLS, HDS, Dash, ad insertion, video players, etc.

- Security:

- Basic: WAF, DDoS protection, bot mitigation, and API security

- Advanced: Application access (replace VPN), Identity Access Management, NG-Firewall, Cloud-based IDT/IPS, DLP, threat protection, forensics, endpoint protection, etc.

- Edge Computing: Edge functions, edge containers/VMs, containerized microservice, and CDN database (strongly consistent + ACID compliant)

The introduction of AWS Cloudfront in 2008 put the entire CDN on the defensive. Google and Azure introduced their own versions of a CDN, together, all three have been chipping away at the commodity business of the CDN (#1 and #2a above). CDNs could do nothing but standby and watch. However, the cloud giants entry into the industry was a blessing in disguise. CDNs were forced to beat the cloud giants in the only way they could, product innovation. Because of innovation, we now have several CDNs valued in the billion + range. The best part, edge computing is a weapon the CDN can use to compete and take away business from AWS into two key areas, database services and compute for specific applications.

Security-based CDN Model

The two segments that will emerge from the ashes are advanced security and edge computing. When it comes to security in the CDN industry, there are two types of models, basic and advanced. The majority of CDNs offer the basic security feature set, defined as DDoS protection, bot mitigation, WAF, and API security. And over time, CDNs will continue to add more products to this portfolio.

The advanced security model is more comprehensive in nature. To date, Akamai, Cato Networks, and Netskope fall into this segment. The requirement for being included in this segment, the vendor must build its security stack on top of CDN owned infrastructure. Sooner or later, the security-based CDNs will be in a position to compete directly with the giants of security such as Cisco, Palo Alto Networks, Fortinet, Symantec, etc. This segment is new and the security-based CDNs are in the process of building out their security stack. For Akamai, that simply means buying more security startups. Akamai’s acquisition of IAM vendor Janrain is evidence of the direction they’re going. Why can’t Akamai also do edge compute? There is no way Akamai can take on the security giants and cloud giants at the same time. If AWS can’t do security well, then Akamai can’t do both either.

Cloud Market

AWS continues to lead the cloud market in revenue. In Q1 2019, AWS earned $7.7B and is likely to earn somewhere in the vicinity of $30B for 2019. Microsoft’s Azure business grew 73% in Q3 2019 (period ended in April), however, they didn’t specify how much of the $9.6B of earnings was attributed to Azure. Add Google Cloud to the mix, and the cloud trio is likely earning $10B+ quarter / $40B+ year.

In November 2008, AWS entered the CDN market with Cloudfront. Within three years, they began to wreak havoc on CDN pricing models. During that time, everyone was nervous about their entry. Fast forward to the present and services such as small file/large file delivery and video streaming are being offered at rock bottom prices. Industry expert Dan Rayburn conducted a survey recently on CDN customer pricing and he found that clients pushing large volumes of data transfer every month were getting prices of $.001/GB. That equates to $1,000/mo for 1 petabyte/month of data transfer. Even if those same customers paid 10x more, like 1 penny/GB, that is super low pricing.

CDNs can no longer survive offering just the basic CDN services and video streaming. Yet, 20% of the industry is doing just that. We’re likely to see a shakeup next year if they don’t change their business model. And that is why there will be only two segments in the CDN industry going forward.

AWS Impact on CDN Industry

AWS is single handily responsible for the collapse of CDN pricing or at least more than any other company. However, this story has a happy ending. The CDN services from AWS, Azure, and GCP are basic. To them, CDN is just one product out of hundreds in the product line and a blip on total revenue. In fact, they have been known to give away CDN for free so they could capture more customers, like those who will pay higher fees for products like EC2, Lambda, RDS, etc.

In 2019, the CDN industry will generate $8B to $10B in annual revenue. Not bad for a bunch of startups, up-and-comers, and others who are hustling to make their mark on the world. The CDN industry is very resilient. AWS Cloudfront isn’t beating anyone in the industry with their basic CDN product. With edge computing here, they will be on the offensive in specific areas.

Edge Computing

Edge computing is the savior of the CDN industry. Fastly, Cloudflare, StackPath, and Limelight Networks are leading the charge in edge computing innovation. Over time, other CDNs will follow. The way it works in the CDN industry is interesting – one company creates a cool product, then the rest follow over time. In other words, they have a pack mentality. Edge computing is not only a movement for the industry but a weapon to take on AWS in specific areas of their product portfolio. The AWS customers that are ripe for the taking are eCommerce and gaming.

Edge functions, containerized microservices, edge containers/VM’s, and the ability to maintain state within their edge PoPs will enable CDNs to ingest, process, store, and deliver data right from the PoP. In short, in the coming years, CDN architecture will become more localized, reducing the need for AWS on certain workloads. However, not all workloads will work with this model. Data warehousing and video transcoding are two of many areas where AWS is the best fit.

Once CDNs have their edge computing stack fully developed, they are going to be in a position to simply ask their customers to move their services away from AWS to their platform.

Fastly

Fastly is pricing its shares between $14 to $16, valuing the company at $1.45B. After they go public, they will be in a position to lead the industry in edge computing innovation. Not only that, they will be able to use their lofty stock price to acquire startups and round out their product gaps. The good news, Fastly and their current investors will retain voting control of the company. That’s good news because The Street has yet to fully comprehend the CDN industry. The questions they asked were basic. Surprisingly, one question was asked about edge computing, only one of the most important trends in the history of technology.