Cloudflare is the 2nd unicorn to IPO in our industry in 2019. It joins the chorus of Akamai, Fastly, and Limelight Networks in the public market. Combined, these four deliver a significant volume of the world’s content, video, and applications to online audiences. The other industry heavyweights are CenturyLink and Verizon Media.

Today, Akamai claims to be a cloud security company, and they are, having booked $205M in cloud security revenue in Q2-2019. And Fastly is the $3B company focused on becoming an edge computing leader. But who is Cloudflare?

At its core, Cloudflare is a cloud security company. However, in the last two years, they have been hard at work trying to reinvent the way applications are developed, delivered, and consumed. For the first time in history, Cloudflare and the others mentioned above have the tools, know-how, and capabilities to chip away at specific lines of business in the AWS portfolio. But that’s another story.

Today, we’ll answer the basic question of who is Cloudflare and outline its place in the competitive landscape. To provide a deeper perspective, we’ll compare them to Fastly and Akamai periodically. This is not a financial analysis of Cloudflare, but a technology market overview.

Background

- Company: Cloudflare

- CEO: Matthew Prince – owns 20.2% of Class B shares

- Founded: 2009

- Raised: $332M

- # of Employees: +1,150

- 2018 Revenue: $192.7M

- 2019 Revenue Jan-Jun: $129M

- # of Paying Clients: 74,873

- # of Clients Spending +$100k Annually: 408

Cloudflare Origins

Initially, Cloudflare started off as a CDN. In their early days, the two industry leaders were Akamai and Limelight. Fastly wasn’t born yet. Level 3 was around. And EdgeCast was a hardcore, sales-driven, up-and-comer that was as successful as Fastly and Cloudflare but sold way too early.

Cloudflare was a startup that partnered with hosting companies like Godaddy to offer free CDN services. The partnership defied common sense because there was no money in it. For Godaddy customers, all they had to do was click on the Cloudflare icon (feature) among many others, set it up, and customers were off to the races in using a CDN. As a new startup, Cloudflare didn’t stand out in the crowded landscape.

Fast forward to the present, the decision that defied common sense at that time in partnering with the likes of Godaddy was nothing short of brilliant. By partnering with hosting companies, Cloudflare was able to create incredible momentum that enabled them to sign up 10,000 customers per day at one point. Today, they deliver content for 20M properties, with that number growing incredibly fast.

Cloudflare is no longer a pure-play CDN. Today, they are a cloud security company challenging traditional security vendors like Cisco, Zscaler, and Palo Alto Networks. Tomorrow, they are going to challenge McAfee, CrowdStrike, Dark Trace, and others.

Cloudflare is an aggressive startup that enjoys building features in quality and quantity, and they’re just getting started. You can expect them to continue building more security features this year and next, especially after they’re public. As a private company, they acquired a few startups. As a public company, we can expect them to acquire plenty of startups.

Aside from its cloud security portfolio, Cloudflare is also the leader in edge computing. The Cloudflare Workers and Workers KV product line is a game-changer, in that it brings state to the stateless CDN architecture, an industry first. Now competitors are playing catch up, a sign that Cloudflare is on the right path.

Cloudflare, Being First

Talking about being first, Cloudflare is the first in many things. They are the first company in the world to offer free to low-cost DDoS protection and a low-cost, feature-rich WAF. And no, the basic AWS WAF is not in the same category. Also, they are the first to bring state to the stateless CDN business model, and on and on.

Cloudflare is first in the following:

- Free and low-cost DDoS protection

- Low-cost, feature-rich WAF

- Scrapped the traditional CDN pricing model that charges for gigabytes transferred (GB/$)

- Severless (scripting) and CDN database

- Marketplace for apps

- Domain registrar

- Ethereum Gateway

Competitive Highlights

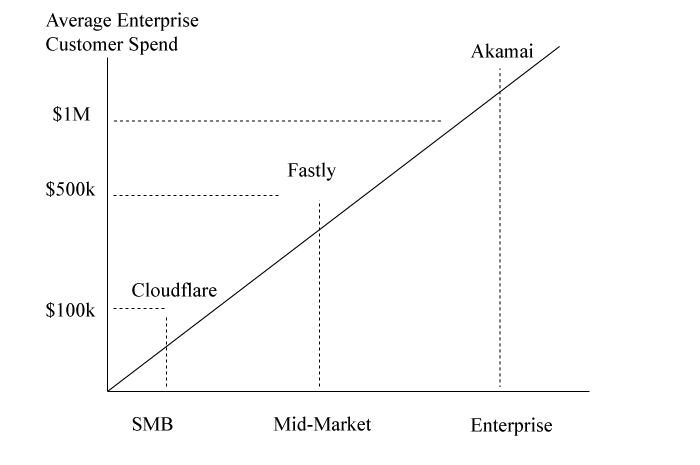

Now that we understand who is Cloudflare, we answer the question, where is Cloudflare positioned in the competitive landscape. That’s best done with a visual.

Average Enterprise Customer Spend is the annual spending for the largest group of customers in the customer base.

Cloudflare vs Akamai

When we look at the Cloudflare and Akamai technology stack, they have similar features. Both offer content delivery, video streaming, WAF, DDoS protection, bot mitigation, application access, load balancing, and have a BGP overlay. Other features are unique to each. Akamai has an IAM product and Cloudflare has Workers (serverless) and Workers KV (key-value store). But that’s where the comparisons end, for now.

Akamai has captured the large enterprise market, from the Fortune 1000 to the largest eCommerce sites to the largest banks, etc. Akamai has a few thousand customers and some of those customers are paying millions of dollars to Akamai annually. Cloudflare dominates the SMB market and has 74k paying clients. Thus, comparing Cloudflare to Akamai in regard to their pricing models, customer base, growth strategy, and business model is an apple to oranges comparison.

So, if Akamai is solely focused on the enterprise market and Cloudflare is dominant in the SMB space, where does that leave Fastly? Fastly started off in the SMB market, then elevated itself to a mid-market leader. As a mid-market player, they can target the SMB market or enterprise. Based on the recent talk coming from the Fastly camp, they are focused on the enterprise market.

Average Enterprise Customer Spend

One important metric for comparing Cloudflare, Fastly, and Akamai is the average enterprise customer spend (AECS), a term used by Fastly in their shareholder letter. It simply means the annual spend for their largest group of customers. The majority of Cloudflare customers are SMB, although they have some enterprise customers. Fastly has more enterprise customers than Cloudflare, and they spend more. And all of Akamai’s customers are enterprise. Obviously, the definition of an enterprise customer is different for each vendor. For Cloudflare, it’s a customer that spends $100K per year. For Fastly, it’s a customer that spends $556k per year. For Akamai, it’s a customer that spends millions annually.

Average Revenue Per Customer

| Cloudflare | Fastly | Akamai | |

| Total Customers | 74,873 | 1,627 | N/A |

| Enterprise Customers | 408 | 262 | N/A |

| 2019 Annual Revenue (estimated) | $260-$290M | $191-$195M | $3B |

| Avg. Enterprise Customer Spend | $100,000 | $556,000 | Millions |

Cloudflare to $500M

Cloudflare is a leader in the SMB market. In the general market sense, we would classify $100k per year in spend as SMB.

Cloudflare is successful as is. They must keep doing what they’re doing now, and the same applies to Fastly and Akamai. There is plenty of room for all three in the industry. Cloudflare doesn’t have to close Akamai-like enterprise accounts to reach $500M. After going IPO, they should double their sales and marketing efforts in order to double the customer base. If they can double the customer base in 2-3 years, which translates to 150k paying customers with 800 of them spending $100k per year, they can reach $500M in annual revenue. That’s realistically attainable.

Sales Distribution

This industry is product-driven. Products and features measure the innovation of a company. However, the sales distribution channel is just as important. A vendor can have the best products in the world, but without the right sales distribution configuration, products won’t sell. We define the sales distribution channel as the medium for which sales occur.

For Akamai, it’s the large sales force of direct sales, inside sales, sales managers, Director/VP of Sales, sales engineers, sales overlays, etc. For Cloudflare, it’s online sales, as they make it easy for companies to sign up. For Fastly, it’s a combination of both.

Akamai has the largest sales force in our industry. As such, they are equipped to personally visit tens of thousands of enterprises annually. A simple LinkedIn search pulls up 2,705 employees that have the word sales somewhere in their title or job function. Many of them are stationed in major cities around the globe. Thus, Akamai has the dominant sales distribution channel configuration for the enterprise market.

On the flip side, Cloudflare has 74k paying customers. Thus, they have the dominant sales channel configuration for online sales. The beauty of online sales, it’s infinitely scalable. They don’t need a lot of feet on the street to close more deals. Cloudflare just needs to spend more on marketing to get the name out there. If Akamai wants to close thousands of more accounts, they’ll need to hire more sales staff.

How about Fastly? They can leverage their online sales platform and sales force to close more deals. Thus, they are positioned properly for the mid-market. A simple LinkedIn search on Fastly with the keyword sales in the title brings up 256 people.

Takeaway

In this snapshot, we provided a unique perspective Cloudflare. Our goal is to provide information on the Cloudflare business model and CDN industry. Cloudflare is a product-driven innovation leader in cloud security. They have taken that mindset into edge computing. We’ll see a lot more in edge computing next year.

Cloudflare has set the share price in the range of $10 – $12. At the high end, they will be valued at $3.5B and raise $483M. We look forward to their IPO.