Just what the market needed, another WAN product. Today, there are 30+ vendors providing SD-WAN solutions. Some are well-funded startups like CloudGenix, while others merely point products from the giants like Cisco and VMWare. Within this group, there are differences in technology, some are product-based and others cloud-based. However, there isn’t much published on the new business model that has emerged, the CD-WAN. The CDN-WAN is the perfect description because it encompasses two business models converging into one.

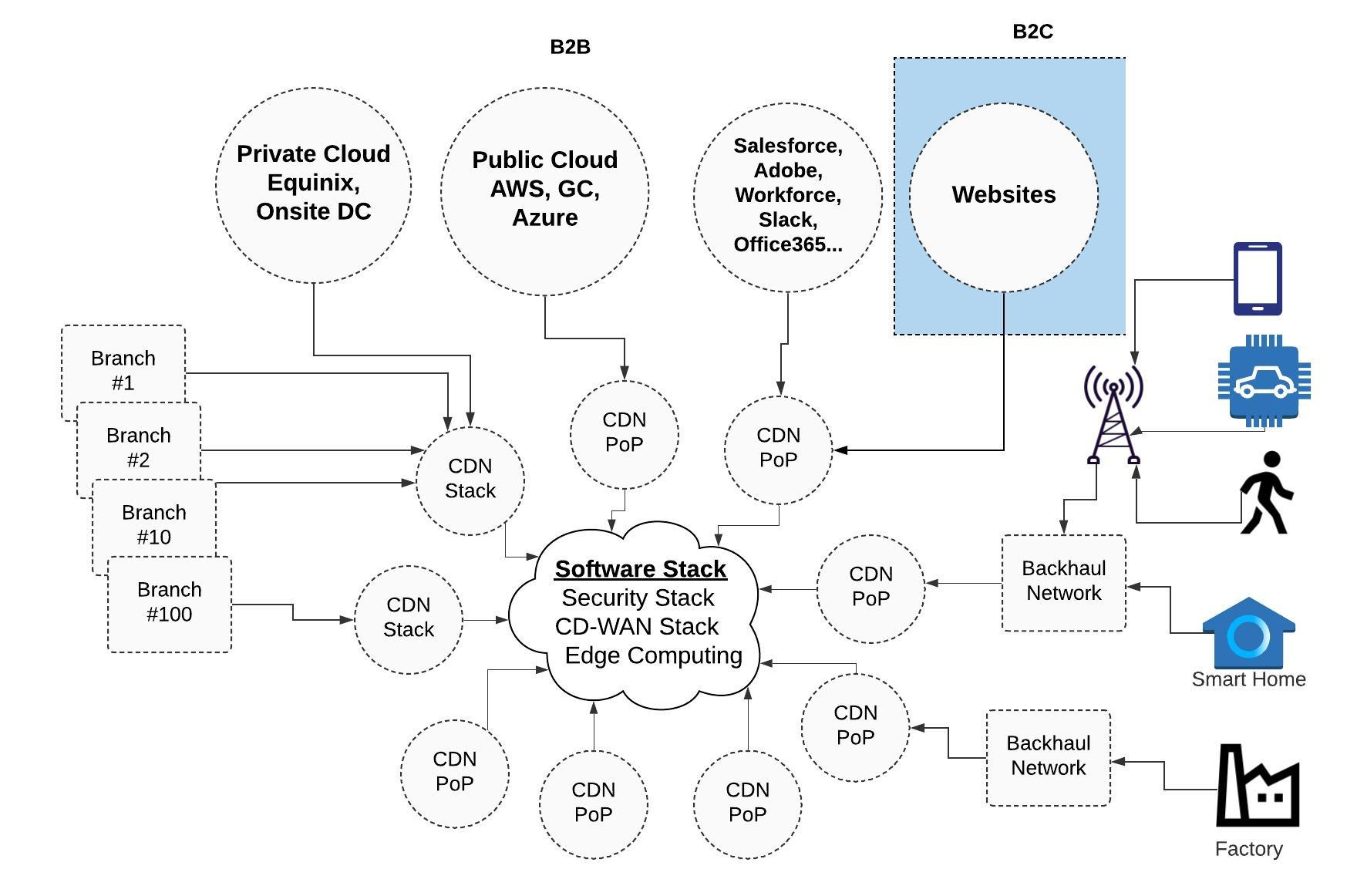

It’s actually more than that, but let’s focus on one. The CDN-WAN is a WAN software stack that runs over a CDN, which means it runs at scale, globally. The best part, it’s 100% cloud-native, cost-effective, provisions in minutes, requires no hardware or software, and is available anywhere in the world. In short, it’s going to redefine the competitive landscape.

SD-WAN Market

For the last couple of years, the WAN (MPLS), network (appliance), and security (appliance) markets have been in a state of significant upheaval. The shift to the cloud is causing once siloed industries to converge, and in turn, traditional vendors, especially those generating significant revenue from appliances are being forced to rethink their business model strategy. Some of these appliance vendors have been unable to adapt, but that’s another story.

What’s the formula for success for competing in the converging markets in the new decade? For the appliance vendor, it requires a radical transformation, in that the software stack residing on proprietary hardware must be completely re-written and re-architected from the ground up to run at scale in the cloud, their own cloud, not AWS. Without a global network in place, appliance vendors will struggle. Telco operators are also feeling the squeeze on MPLS product sales as cloud-based providers such as Cato Networks offer a better alternative. However, now there is new vendor entering the market, actually, it’s more like an industry entering the market, and that’s the CDN, and their value proposition is very compelling.

The tech industry is like Wall Street, there are winners and losers. The losers are the appliance vendors and the winners are the CDNs. The CDN is in a great position in the new decade, call it a combination of luck, hard work, and timing. For the CDN industry, convergence isn’t new, it began years ago. During this time, the CDN product leaders have transformed their business models to thrive in the converging marketplace.

CDN Stack

For more than two decades, CDNs primary focus has been on providing the best global network performance possible. Vendors competed fiercely on performance, always trying to prove their network was a few milliseconds faster than the competition. Being able to provide better performance in the milliseconds range is life and death to a CDN. The performance mentality has led CDNs on a path to the continuous optimization of global network performance, ensuring the right carriers, routers, peering points, data centers, routing policies, and so on, were in place. With years of experience in network optimization and caching platform enhancements, the CDN business model is at the center of the universe in the cloud-native converging marketplace.

The CDN industry has also been in a state of transition. Currently, there are 31 CDN vendors worldwide, not counting the cloud giants but counting Verizon Media (EdgeCast), CenturyLink, and Comcast. The bottom half of the industry has been asleep at the wheel, operating business as usual. The top half has been hard at work transforming their business model for the new decade, investing in edge computing, security, and WAN. Today, there is no longer any distinction between legacy CDN vs the next-gen CDN or black-box CDN vs open CDN. The CDN is just a networking stack, which we refer to as CDN stack. That’s it. The software stacks that CDN vendors decide to build on the CDN stack is what differentiates them.

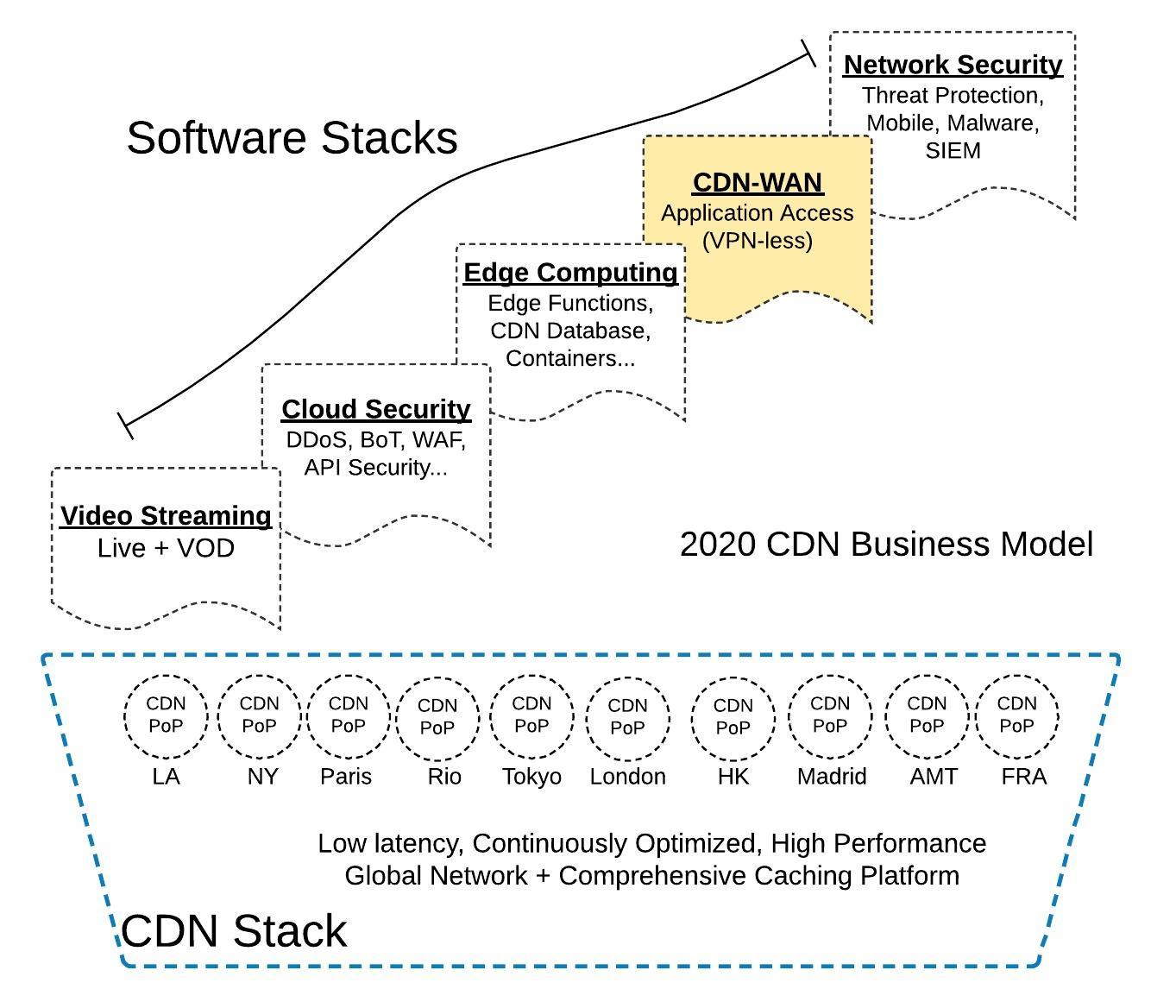

The CDN stack is extremely valuable, where it supports various software stacks, including cloud security, edge computing, WAN, etc. To the CDN, the WAN is nothing more than a feature, and CDNs have lots of features. The WAN is not a business model for them like it is for other vendors, and that’s dangerous. It dangerous because they can drop the price to zero if they like and drive legacy vendors out of the market. The oldest stack in the CDN portfolio is video streaming, which is a commodity nowadays. The most promising stack is edge computing, which allows developers to build software apps that run at the edge.

In the diagram above, we illustrate the concept of the CDN stack and software stacks that reside on it, including the CDN-WAN. From a competitive standpoint, every software stack that a CDN develops, it enables them to compete in an established market, usually where appliance vendors reign supreme. What happens next? We’re likely to see CDNs with a CDN-WAN product slowly chip away the market share of the appliance vendors in the next couple of years, and there isn’t much the appliance vendor can do to fight back.

The Market

Recently, Gartner published an in-depth research report called “The Future of Network Security Is in the Cloud” and it has caused quite a stir. We believe it’s one of their best pieces of research in recent memory because it encompasses everything that is taking place in the infrastructure market over the next decade. In short, Gartner points out that the data center is no longer the center of the universe since more data is being generated outside of it. Instead, applications and services reside everywhere. Therefore, network and security business models must adapt to the new world order called SASE (Secure Access Service Edge). Gartner identifies the key players in the SASE world and that list includes Cloudflare and Akamai.

In the report, the CDN industry is squeezed in there between many other vendors and a bunch of features. However, we can say that the CDN industry is quite unique and there is really no industry like it. Think of it as a highly-focused and highly-specialized AWS model. Whereas AWS is the jack-of-all-trades business model and innovator-of-none, the CDN industry is the opposite, it’s a best-of-breed model and innovator in CDN edge computing, CDN security, and CDN-WAN. The emergence of the new CDN business model is going to challenge and disrupt many industries, especially the old guard.

CDN-WAN Players

Presently, there are three vendors offering CD-WAN products 1) Cloudflare 2) Akamai and 3) Instart. More will come out later in the year. Cloudflare is the product innovation leader in CD-WAN, followed by Akamai, then Instart. Instart’s product is in beta. The requirements for being classified a CDN-WAN player must have the following 1) CDN Stack 2) application access and features and 3) WAN fully integrated into the CDN stack.