We’re midway through Q2-2020 and industry activity is at an all-time high. We’ll summarize the latest market developments starting with Cedexis, then follow up with Edge Gravity, Subspace (new CDN), and more.

Is Citrix Shutting Down Cedexis

Rumors have been flying around for the last several months that Citrix is shutting down Cedexis and began laying off employees. Although this event is not as tragic as Oracle shutting down Dyn, it’s unfortunate. It has been said that Cedexis was generating <$30M per year. Even $1M in MRR would have been good for any CDN but not Citrix. Citrix generated $3B in revenue last year, thus Cedexis revenue is a drop in the bucket for them. A smarter move would have been to sell it for pennies on the dollar, keeping the product intact and the team in place.

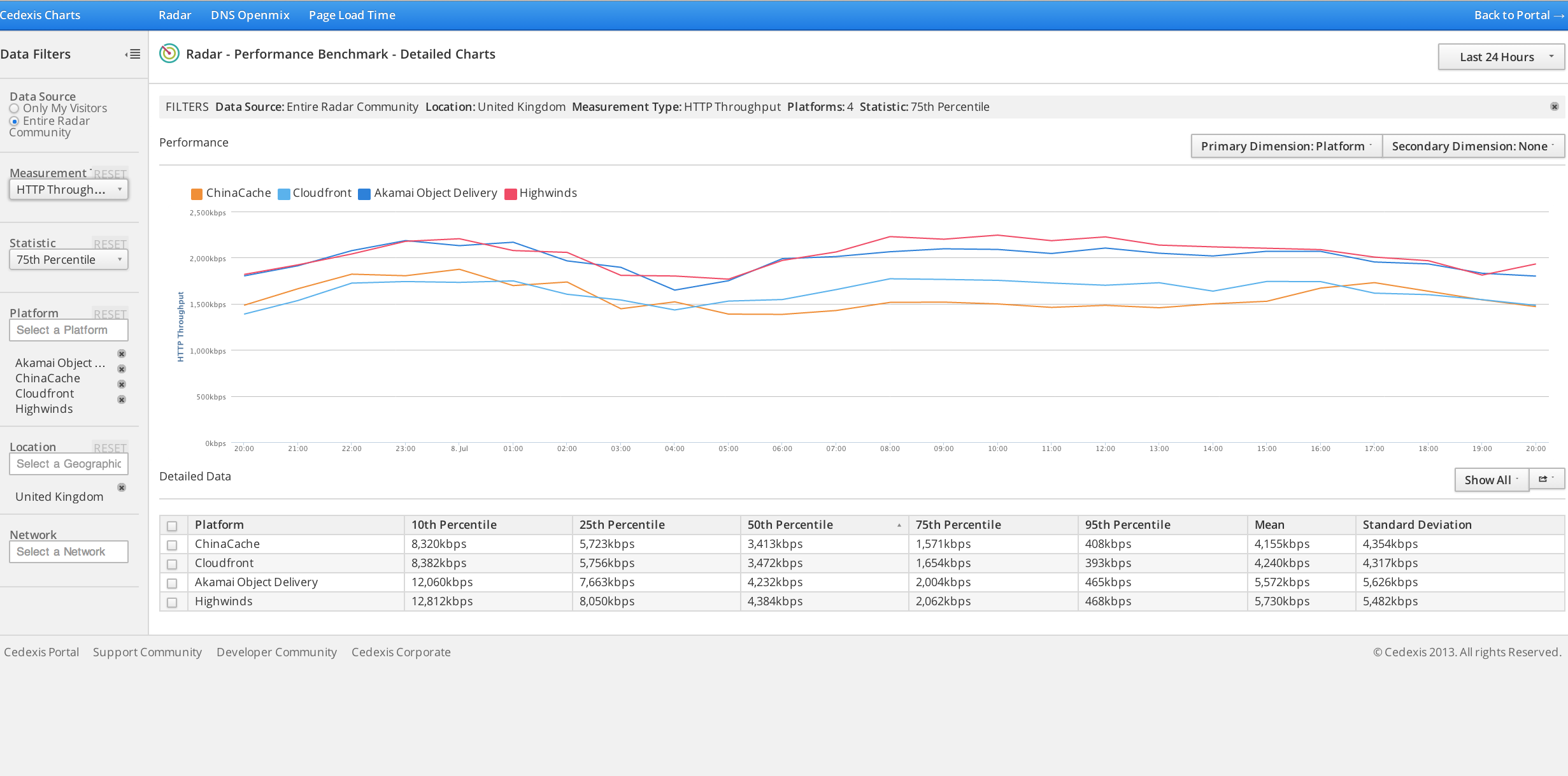

More than a decade ago, the only network analytic tools available for benchmarking CDN performance were Gomez Last Mile and Keynote. They were expensive 1st-gen tools used by all CDNs. Thereafter, a few startups emerged providing a competitive offering and a niche was born. Cedexis was a pioneer in the space. Other players include CatchPoint, Conviva, NPAW, ThinkAnalytics, MUX, and PerfOps, each vendor providing a different flavor of analytics. What has the industry learned about this niche? It’s small and no one has reached unicorns status yet. Here’s a snapshot of a Cedexis test from 2016.

Edge Gravity Lays off 50 Employees, Closes Twitter Account & Unplugs Website

On April 27, industry analyst Dan Rayburn announced that Edge Gravity (Ericsson) laid off 50 employees. On top of that, they’ve deactivated their Twitter account and unplugged their website, which is redirecting to another page now. Is this the end of Edge Gravity? Edge Gravity is not the only one that will be impacted by its demise, so will Limelight Networks, at least to some degree.

Initially, Edge Gravity built a basic CDN and started selling CDN services. However, their platform was plagued with problems. Thereafter, Edge Gravity signed an agreement with Limelight Networks and in doing so, got out of the CDN business. The new alliance was supposed to create a new revenue stream for Limelight, believed to be in the millions, and they mentioned this alliance on several analyst calls. Thus, if Edge Gravity ceases to exist, what happens to the revenue that Limelight was supposed to realize from the alliance.

Subspace: New Startup CDN

A new CDN has emerged from stealth mode called Subspace. The Los Angeles-based startup is focused on the gaming industry. They have raised $26M and hired ~50 employees. The co-founders are Bayan Towfig and William King. Bayan recently stated the startup has generated 8 figures in revenue over the last several months. If that turns out to be true, it would be an incredible accomplishment for a CDN, perhaps even a record since they were just founded in 2018.

Subspace has signed up Funplus, a Chinese gaming company and as a result, the startup has “millions of players on their network”. The startup doesn’t mention anything about their technology stack except they’re “installing software and hardware for ISPs everywhere” and they “build deep tech in global networking (Layer0 (DWDM / HF Radio) to Layer 7)”. I’m sure we’ll see more information on their stack and business model once they hire a CMO.

Background

- Company: Subspace

- Founded: 2018

- HQ: Los Angeles (Playa Vista)

- Raised: $26M

- Founders: Bayan Towfig (CEO) and William King (CTO)

- Product: CDN for gaming

- Customers: Funplus (big Chinese mobile gaming company),

Investor Reactions

Investor reactions to CDN earnings were all over the map. Fastly wowed investors with their earnings, driving up their stock price and market cap. With a $3B valuation, Fastly must go on the hunt and acquire new technology. It simply cannot build everything in-house fast enough. Time is of the essence and they should start by acquiring Garrison.

Reactions were mixed on Cloudflare. After earnings were announced, Cloudflare stock rose, only to fall again, then rise again. The culprit seemed to be expenses, which increased more than expected. Our advice to Matthew Prince & Company is to ignore Wall Street and continue to invest in PoPs, products, and new hires. As an 8-month-old public company, Cloudflare has a long way to go to reach its full potential. To reduce expenses at this point would be counterproductive.

Akamai reported solid earnings and their stock does as it always does – hover in the range of $80 to $100 per share. It might digress from there, but it always goes back. The only thing we can say about Akamai is they’re predictable.

Then we have Limelight. Limelight announced solid earnings and The Street just yawned. The problem is perception. Limelight has disappointed investors so many times over the years with mediocre earnings that even an earnings blowout would fall on deaf ears. It’s going to take a spectacular event for Limelight to surpass the billion-dollar mark.

Industry Updates

- Blockchain CDN startup Gladius Networks has shut down. It’s a tragic end to the blockchain startup that raised $12.7M in October 2017 during the peak of the ICO hype cycle. The lesson learned from this fiasco is that blockchain and CDN don’t mix.

- Verizon has launched new capabilities including Report Builder, support for WebSockets, Ad Analytics, and Control for live video and VOD.

- StackPath has turned five years old, having started in 2015. Four years ago they acquired MaxCDN and three years ago Highwinds.

- Imperva has introduced Advanced Bot Protection, which they probably hope puts them in the same league as PerimeterX and Akamai Bot Manager.

- Microsoft is launching Azure Edge Zones. They’re basically taking their infrastructure and services (including CDN) in the central cloud and putting them into carrier data centers in order to provide lower latency solutions required by edge applications.