Years ago, it was Oracle vs Microsoft, Qwest vs MCI, and Akamai vs Limelight, the few of the many rivalries that entertained us. Today, it’s Cloudflare vs Fastly. Although both are civil towards each other in the public eye, make no mistake, they are rivals that were founded around the same time, IPO’d months apart, and are generating annual revenus in the same ballpark.

Pay close attention to their history, read between the lines, and observe the small details, in doing so, one notices the bitter exchanges between the two primary CDN innovators. Sorry Akamai, you’re old school. Cloudflare and Fastly represent the future of the CDN industry. In the world of sports and business, rivalries are welcomed because each participant challenges the other to become better, elevating themselves and the industry in the process.

However, this rivalry is different because although they may compete against each other every so often, the real battle is winning the hearts and minds of the DevOps community and investors, proving they are the best of the pack. Cloudflare and Fastly’s two primary opponents are the 1) cloud trio and the 2) security industry. They really could care less about Akamai, the giant CDN that operates in a small market. The cloud trio is on track to generate $105B in annual revenues this year, led by AWS, that’s the place this duo wants to compete in.

Cloudflare Workers vs Fastly Compute@Edge

Earlier in the month, Fastly called V8s an off-the-shelf technology, bound with limitations, hence the reason they selected WebAssembly and built a compiler they call Lucet which plays nice with JavaScript. In another post, Fastly pointed out that V8 cold starts were a problem because it took too long to load. Also, security was lax in V8. Using WebAssembly, Fastly reduced cold starts to under 35 microseconds. Cloudflare is not one to shy away from a fight, one month later, low and behold, they responded in force, providing excruciating detail of their security architecture and zero cold starts, thus beating Fastly’s 35 microsecond start times.

Fastly’s compiler Lucet was “built on top of Cranelift code generator”. The question we have for Fastly, if they are using WebAssembly which was developed by a consortium and Lucet, which was built on top of another product, isn’t that by definition an off-the-shelf product just like Cloudflare’s, Lol. The bottom line, V8 (built by Google), and WebAssembly (built by a consortium including Mozilla) are great products. If it’s good enough for Google and Mozilla, it’s good enough for Cloudflare and Fastly.

CDN Edge Computing Landscape

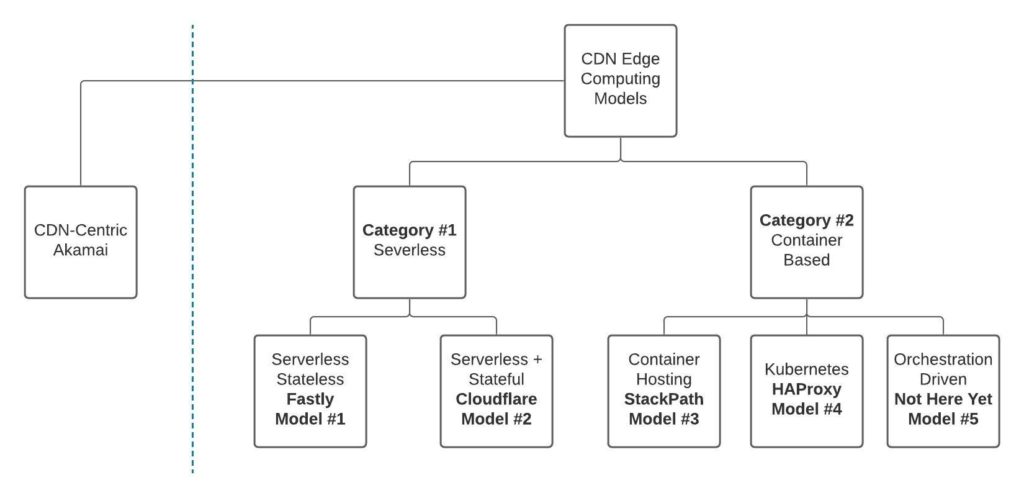

Onto a more serious matter, today, there is enough public data to identify the different edge computing models in the CDN industry. The term edge computing is nothing more than an umbrella term that has no specificity to it. In the CDN industry, there are two categories of edge computing, serverless and container-based, and five different models, as illustrated below.

In our industry, Cloudflare was the first-to-market with its serverless product called Workers (now Workers Unbound). Thereafter, they developed the first version of a CDN database called Workers KV, a simple key-value store that brings some form of state to the otherwise stateless serverless offering. But for Cloudflare, that’s not enough. CEO Matthew Prince stated that a more sophisticated distributed database is needed, that will make it easier for customers to port over applications to their platform and provide the necessary “speed, consistency, costs and compliance benefits”. At the present time, they are “investing heavily” into this product.

Fastly introduced their serverless product two years after Cloudflare. It uses WebAssembly and it’s fast. However, there is no indication they plan to develop a CDN database. Instead, it seems they prefer to partner with the cloud giants. In our opinion, that’s not an ideal approach for many reasons that go beyond the scope of this discussion.

Then we have StackPath who is following in the footsteps of Cloudflare but have a ways to go in the serverless arena. However, they do host containers at the edge, but it’s a manual process in that customers must pick the type CPU and amount of memory. HAProxy has built its own dedicated network, although the footprint is small at this point, and developed a suite of products that work in the Kubernetes ecosystem. In fact, their load balancer provides similar features to Envoy proxy.

Finally, we have the last model, identified as model #5. Today, there is no CDN yet providing this type of functionality. Model #5 is something we’re are likely to see in the next 2-3 years. In terms of what it does, the model is like StackPath on steroids where an orchestration stack is able to spin up containers on-demand, determining how much CPU and memory is required for each workload, and placing the container/workload to the most appropriate PoP best suited to meet that use case. In a way, it works like serverless, in that the infrastructure is fully managed and the orchestration platform makes all the deployment and management decisions in regards to infrastructure.

These models are likely to change in the future, as the technology behind serverless and containers at the edge matures. Call this a snapshot in time. Serverless in the CDN industry is three years old, and it will take another 3-4 years for the market to fully mature, around the same time it did with the CDN security model. However, that’s no excuse for vendors to do nothing now because once the market matures, it will be too late for those vendors if there is nothing in place.

Future of the Edge Computing Market

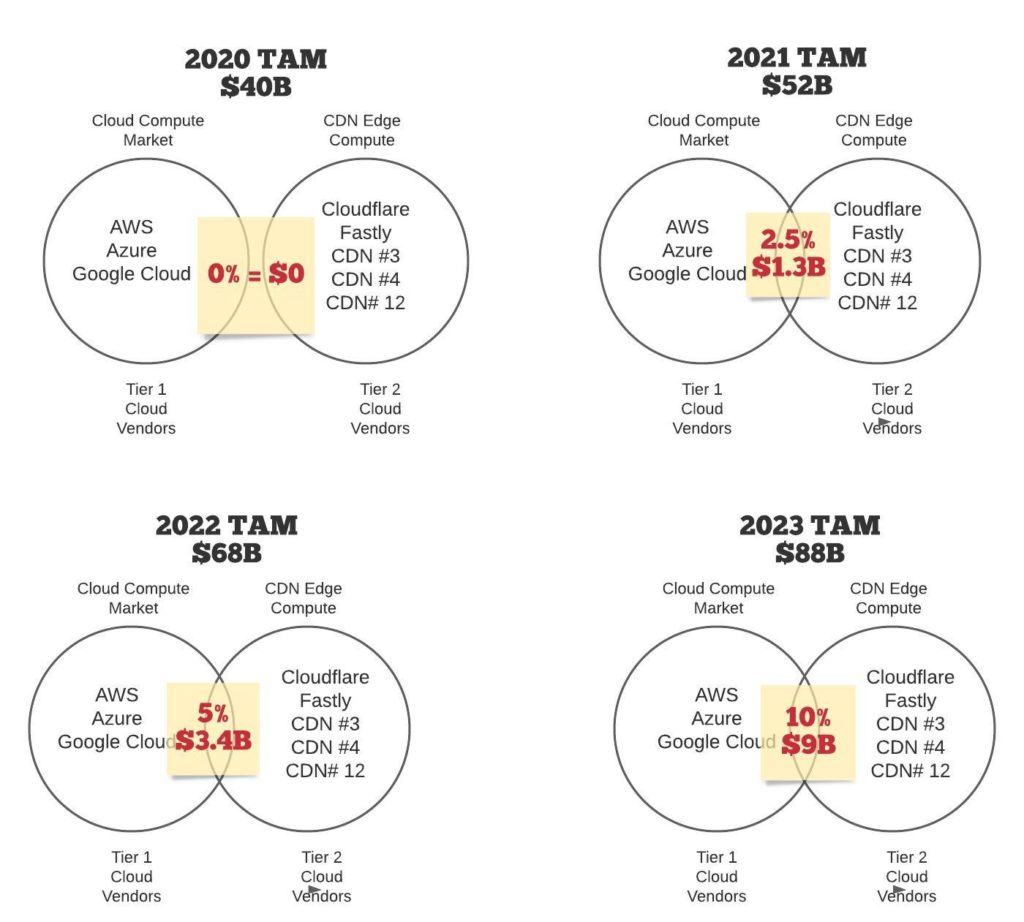

The general cloud computing market size for 2020 is $266B. For 2020, the forecasted revenue for AWS, Azure, and Google Cloud is $105B. However, the $105B includes product revenue from services that CDN’s are unfit for, like backup/restore, data warehouse, AI training, Office365, Google Suite, etc. Thus, we must subtract the irrelevant product revenue from the $105B to come up with a TAM (total addressable market). Using our own proprietary method, which is another way of saying we don’t want to share the details now, the TAM is $40B for CDN edge computing. Whether the TAM is $30B, $40B, or $50B, it’s significant any way you slice it.

The most difficult question in which there is no answer to is how much of the cloud computing market can the entire CDN edge computing ecosystem capture from the cloud giants? For demonstration purposes, we used the following percentages:

- 2020: CDN’s captured zero market share from the cloud giants

- 2021: CDN’s capture 2.5% of the TAM

- 2022: CDN’s capture 5% of the TAM

- 2023: CDN’s capture 10% of the TAM

Based on these numbers, this is what we come up with.

Forecasted 30% growth YoY

One of the reasons we like using a TAM derived from the $105B is because this market (cloud) is the low hanging fruit for the CDN industry. Stripe, Zendesk, Shopify, and many of the largest users of CDN services also happen to spend millions on AWS, Azure, and/or GCP. Thus, there are relationships in place between the buyers of cloud services and CDNs. CDNs need nothing more than provide a great serverless product and give a great sales pitch like we’re faster, cheaper, and better than AWS to capture market share. Yeah right, only if it were that easy.

In summary, the market opportunity for CDN edge computing is going to be significant in the coming years. There is enough TAM to go around for many vendors, unlike CDN security where Akamai mopped up.