After an 18-month hiatus, we’re back in business. A lot has happened in that time. Eighteen months ago, Fastly’s stock was ~$94 per share, Cloudflare’s was ~$39, and Akamai’s top brass was making bold statements on its earning call about how “we’re the largest provider of edge computing services by far. We have been doing it for close to 20 years. And the idea that this is how somehow something new is just not true.”

Fast forward to the present. Fastly’s stock is down. Cloudflare’s is up. And Akamai is still the largest provider of edge computing services in our market. But these events are insignificant compared to many other things that have taken place.

Today, Cloudflare is #1 and Akamai #2 in market cap. That’s a stunning accomplishment for Cloudflare, considering that Akamai has been the 800 lb gorilla dominating for two decades. For the first time, they’re eating humble pie.

What are some of the essential highlights in the last 20 months: 1) Verizon sold EdgeCast to Apollo, and Apollo sold it to Limelight 2) Limelight acquired Layer0, a competitor of Netlify and Vercel 3) Fastly acquired Signal Sciences 4) FaaS takes off and becomes the pillar for CDN edge computing 5) CDNs are building data stores to help maintain state at the edge and 6) Akamai admits its past mistakes.

A lot is going on here. We’ll explore these topics in later posts. For now, we’ll comment on two industry-impacting events that involve Limelight and Akamai. First, Layer0 is one of the core pieces for Limelight’s radical transformation. The other missing piece is a cloud play. Acquiring a startup like VULTR would provide Limelight with a complete cloud stack. And Akamai’s acquisition of Linode is a game-changer. We’ll explore that in the Akamai post that’s coming.

Industry Snapshot

As an industry, the CDN ecosystem has never looked better. There are four public CDNs to compare and contrast features, financial metrics, vision, etc. In the past, Akamai and Limelight were the only public companies. And it wasn’t a fair matchup. As a result, we had to expand our research to startups. The issue with that was there was no way to validate anything since they were private companies. Akamai, Limelight, Cloudflare, and Fastly are excellent representations of the market. Therefore, we’re going to stick to them for now.

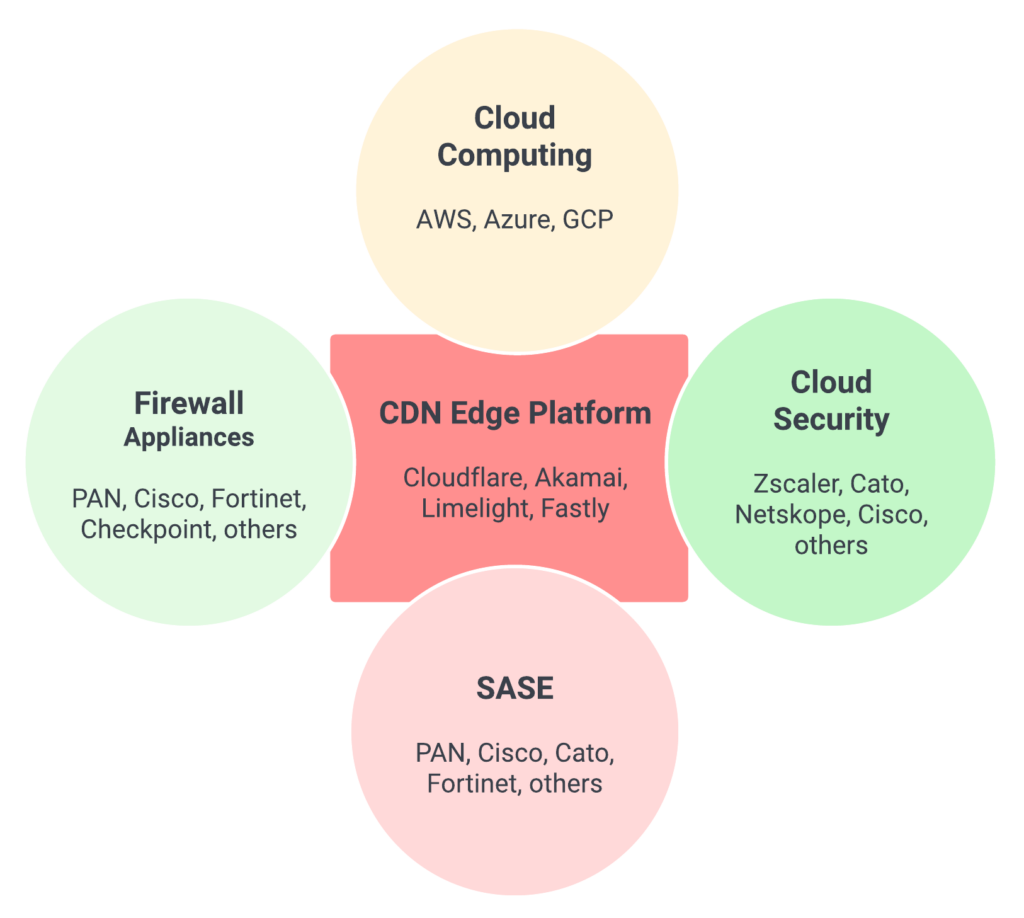

What is the next growth engine for CDNs? CDNs are no longer the CDNs of the past. Instead, we call them that because that is their origin. Today, they are complex, hybrid business models taking on many industries. Industry growth will come from security and computing.

What’s Next

In the coming days, we’ll publish more observations. Also, we’re going to offer a paid newsletter. More on that soon.