Fastly has come a long way since its IPO in May 2019. In 2021, they generated $354M, employed +1,000 people, and hired a CFO, CRO, CMO, and CPO. The CPO worked at Google for several years in global networking, a plus because Fastly needs to develop and release more products.

Recap of 2021

Last year Fastly reached several milestones. Here is a list of key takeaways from their 2021 annual earnings call.

- Q4 2021 revenue was $97.7M, a “13% quarter-over-quarter organic increase.”

- Signal Sciences was 11% of Q4 revenue

- 2021 Revenue was $354M, a 22% increase YOY, and they had $1.1B in cash

- 2,804 customers and 445 of them spending more than $100k in ARR

- In Q4, they added 56 net new customers and 15 net new enterprise customers. In Q3, 167, and 22, respectively

- In 2021, the Top 10 customers contributed 33% of revenue, and in 2020 it was 38%

- The gross margin was 55.8% in Q4 and 57.5% in Q3. No price compression in Q4.

- ~200 Tbps of global network capacity

- Fastly delivers half the traffic of Akamai with 98% fewer servers. That means Fastly has 7,300 (2% x 365k) servers globally deployed.

- Compute@Edge now supports JavaScript, Swift, and Zig.

- Introduced Cloud Deploy: wizard for automated deployment workflows

- Fortune 50 financial services company deployed Signal Sciences WAF

Nothing above is extraordinary. However, Fastly announced a goal to triple revenue to $1B by 2025, equating to a 30% CAGR. The next earnings call is on May 4, 2022, to report on Q1.

Acquisitions

In August 2020, Fastly acquired Signal Sciences for $775M. Signal Sciences was an emerging leader in cloud-based WAF and RASP. The acquisition was an excellent move that helped fill a gap in their security product line. Signal Sciences generated $28M in ARR and had 85% gross margins. The security startup protected 40k applications and had several thousand customers, including blue-chips like DataDog. Thus, there is an upside in those relationships in that Fastly can upsell them additional products.

In March 2022, Fastly acquired Fanout, a small startup that helps users build APIs. Any acquisition Fastly makes a positive as it expands its portfolio of services. However, the purchase is not as industry-impacting as Akamai acquiring Linode and Limelight acquiring EdgeCast; instead, Akamai and Limelight have the pieces to transform their business model.

Industry Position

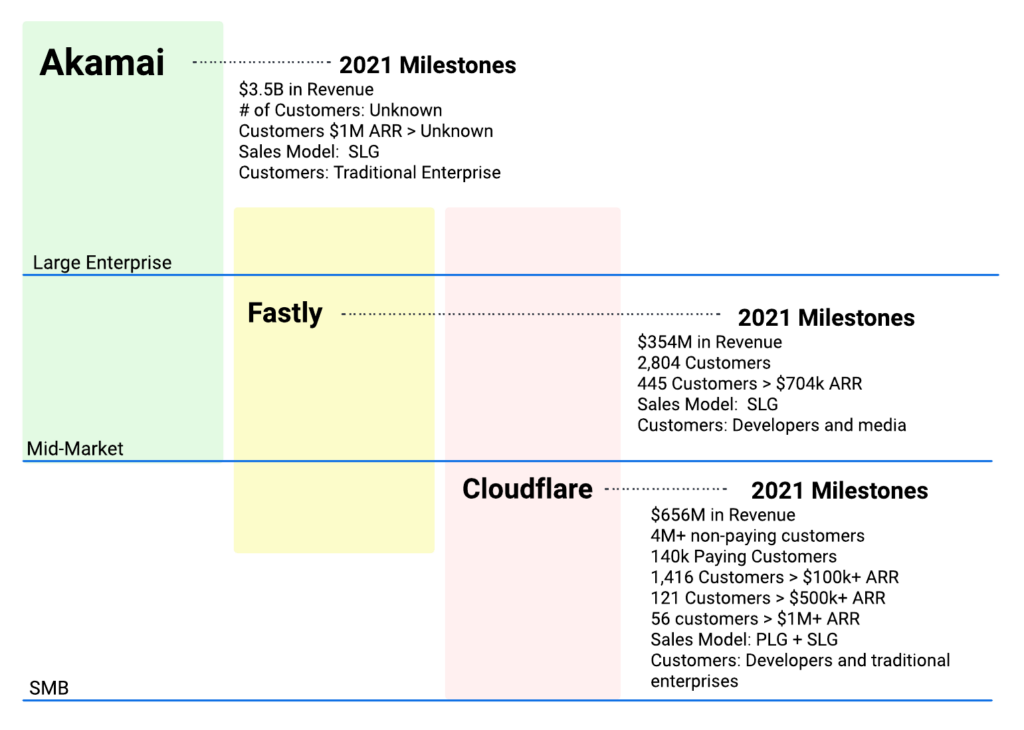

Akamai is a fierce competitor to Fastly in the enterprise. Cloudflare is a fierce competitor in the SMB segment. We could say they are getting sandwiched between two larger rivals. The graphic below illustrates the position of three of the four public CDNs.

Next Big Move

Fastly’s revenue grew 22% in 2021. If revenues increases at the same pace in 2022, they will fall short of their 30% CAGR goal. Although Signal Sciences provides Fastly a new market to go after, will it be enough? If we’re playing the conservative, no.

The CDN market is highly competitive. Stable growth must come from security and edge products. The only challenge with Compute@Edge, it’s likely to take years before it contributes to the bottom line in an impactful way. The only logical solution to rapid growth is through an acquisition or several.

What would be the ideal acquisition that could be industry-impacting? Akamai acquired Linode. Limelight acquired Layer0. Fastly must do something along the same lines. And while all that is happening, they should continue introducing innovative products like Object Store.