Cloudflare IPO’d in September 2019. That was a special day for the industry as we now have four public CDNs to compare and contrast. We refer to them as a CDN because that is their origin. But in reality, they are hybrid business models providing computing and security solutions.

Presently, Cloudflare stands alone as the ideal business model in the highly competitive industry. They’re firing on all cylinders; subscriber growth, ARR, CAGR, product development, and product-led growth (PLG). So there isn’t anything they should do differently.

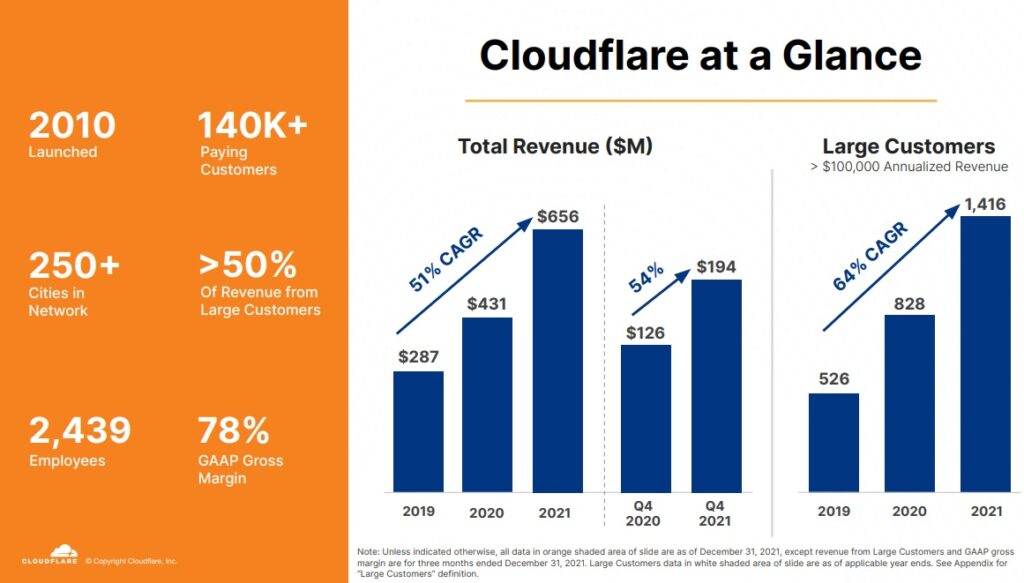

Last year Cloudflare generated $656M in revenue. This year, the forecast is coming in at $929M. If Cloudflare generates $1B in revenue in 2022, it will be a significant milestone that only Akamai reached several years ago. The bigger question is when can they earn $2B in ARR.

Before we answer that question, here is a recap of their Q4 earnings call. The data points help bring context to the discussion.

- Q4 revenue is $194M, 54% YoY

- 2021 revenue of $656 million, 52% YoY

- US revenue = 52%, EMEA = 27%, APAC 14%, rest = other regions

- The gross margin was 79%

- 140,096 paying customers and added 29k paying customers in 2021, a 26% increase YoY

- 1,416 large customers ($100k+ ARR)

- Added 156 large customers in Q4 and 588 in 2021

- 121 customers spend more than $500K MRR

- 56 customers spend over $1M

- Large customers (ARR > $100k) represents 54% of total revenue

- Increase network CAPEX to 12% – 14% of revenue

- Employees: 2,440

- 200,000 domains sign up for email routing services almost overnight

- R2 Object Store has 9k signups for the closed beta, hundreds of petabytes of storage

- Acquired Vectrix, a CASB startup that onboards customers quickly

- Fortune 500 telco signed $1M ARR contract with 100k seats

- The Workers platform is 4.5 years old as of Q4 2021

On the same earnings call, the CEO stated that “we expect to use this exceptional gross margin as a weapon to take business from competitors more vulnerable than we are to pricing and cost pressures. It also allows us to bundle products into a comprehensive platform no competitor can match.”

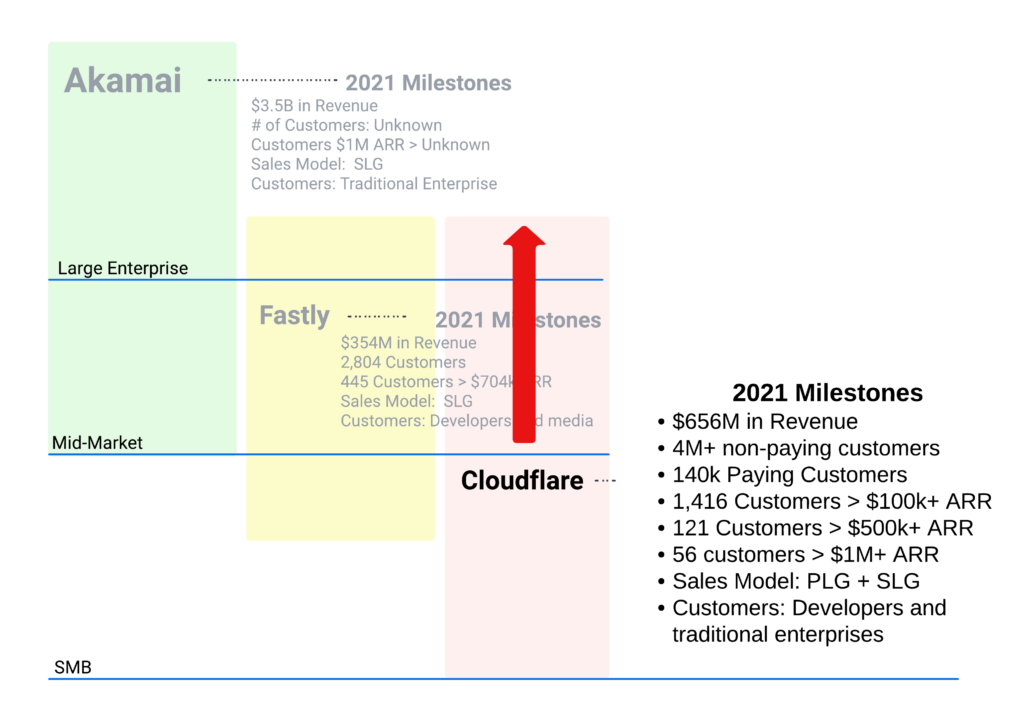

The #1 key takeaway from the highlights above; Cloudflare is a leader in the SMB segment and a fierce competitor in the enterprise space. And who is the dominant enterprise player? It’s Akamai. Thus, this competition is going to get interesting.

PLG, SLG, and Channel Strategy

Cloudflare has the ideal sales growth model for several reasons. First, their PLG (product-led growth) model is the envy of the industry. At last count, they had +4M, non-paying subscribers. That’s a dream come true because all they have to do is convert a small percentage of those subscribers into paying customers to impact revenue. What happens when they have 10M, non-paying customers? It will be a gift that keeps on giving for years.

Second, their SLG (sales-led growth via direct sales) model performs well. They’ve hired a ton of salespeople in the US and overseas. It is they closing these large customer deals. Third, the channel program is performing well. That department has increased its headcount. PLG, SLG, and channel work in cohesion to generate 50%+ growth. The direct sales force wins big deals while the PLG engine captures the SMB segment.

Growth Profile

In Cloudflare’s investor deck, the slide below is the most interesting. It speaks volumes of their growth in paying subscribers, total revenue, and large customers. So there isn’t much to add here.

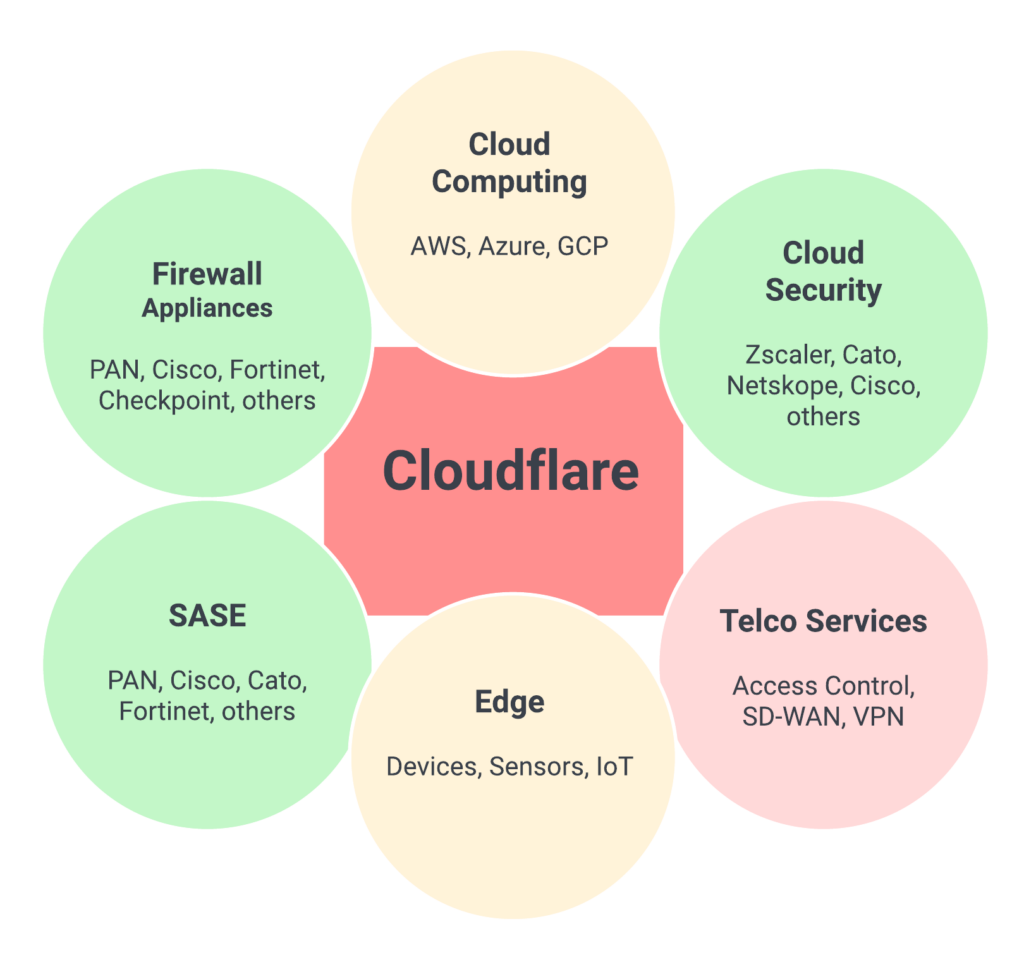

New Markets

Cloudflare is a hybrid business model that offers an extensive product line and competes in different markets. They are a CDN, security company, a networking company, carrier, and computing company. They can creatively bundle or discount a product to price out the competition in every deal they compete. The diagram encapsulates the markets they compete.

When to Expect $2B ARR

Based on their current growth trajectory, it’s likely to occur in 2024. If and when it happens, it won’t be a surprise. So the million-dollar question is, when can Cloudflare generate a $5B annual run rate? Before Akamai? How about the same time as Akamai. Time will tell.

Disclaimer: I’m not giving investment advice or financial recommendations.