Suddenly, Limelight Networks is the most exciting CDN in our entire ecosystem for the first time in years. How did they manage to pull this off? Two strategic acquisitions have enabled the company to transform itself and impact the industry. First, it seems the impact has gone unnoticed—the reason why is that there are many moving pieces to this puzzle.

Let’s put the pieces together.

The New Limelight

When Limelight acquired EdgeCast, it jumped over Fastly to become the #3 CDN in revenue. Once the deal closes, they will generate ~$500M in ARR. In one move, Limelight becomes the largest media CDN after Akamai, not counting the cloud companies. EdgeCast is known for having lots of large media clients. These blue-chip clients are hard to come by. One of the main benefits of the acquisition-there is minimal overlap in customer accounts.

Media CDNs

EdgeCast has a mature video product line that is on par with Akamai. As one company, Limelight and EdgeCast will have a network capacity of 200Tbps and 300 PoP. Lumen is a media CDN, but they are a very distant 3rd. The impact of the consolidation of media CDNs means there are only two significant players in that space, Akamai and Limelight. Thus, when there is a big event, or media property needs to deliver dozens of petabytes per month, Limelight will always be in the discussion. And since the multi-CDN approach is a must in this space, Limelight should see more traffic in the coming quarters.

Google’s media CDN is not a threat to Akamai and Limelight. First of all, this solution is more of a subset of the much bigger GCP. Second, their newbies to essential services like live streaming. Although this might work for a company like Vimeo, it will not be a fit for mission-critical streaming projects that require hands-on white-glove service and subject matter experts in the video ecosystem.

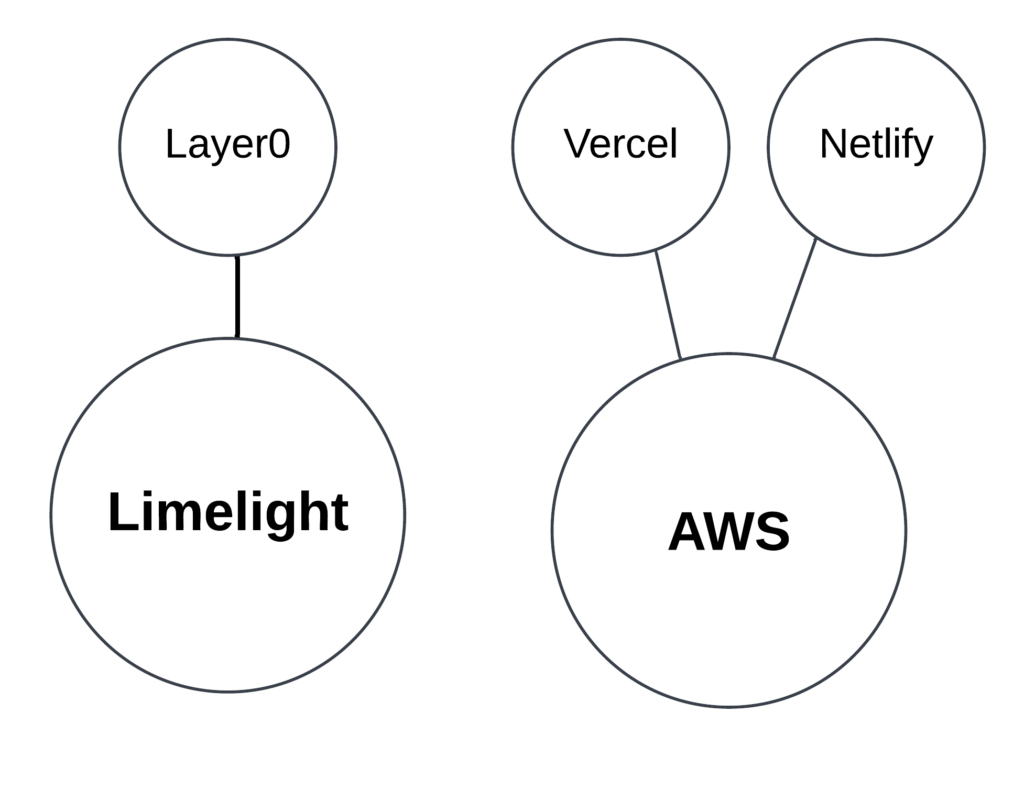

JAMStack

The more critical acquisition is Layer0. By acquiring Layer0, Limelight has become the #1 CDN in JAMStack. Layer0 had a current run rate of $13M to $14M in Q4 2022. They forecast that Layer0 will generate $20M in revenue in 2022. That would put it in the same revenue range as Netlify and possibly Vercel. For those who don’t know Netlify and Vercel, they are two unicorns leading the JAMStack movement. Last year Netlify was valued at $2B and Vercel at $2.5B.

We would say that Layer0 will eventually have the cost and performance advantage over Netlify and Vercel because they use the global network of Limelight Networks. Since Limelight owns the network and has excess capacity, there will be minimal infrastructure fees such as egress fees, content delivery fees, etc. On top of that, Layer0 is likely to be deployed in many of the 300 PoPs at its disposal.

As a result, performance will be top-notch.

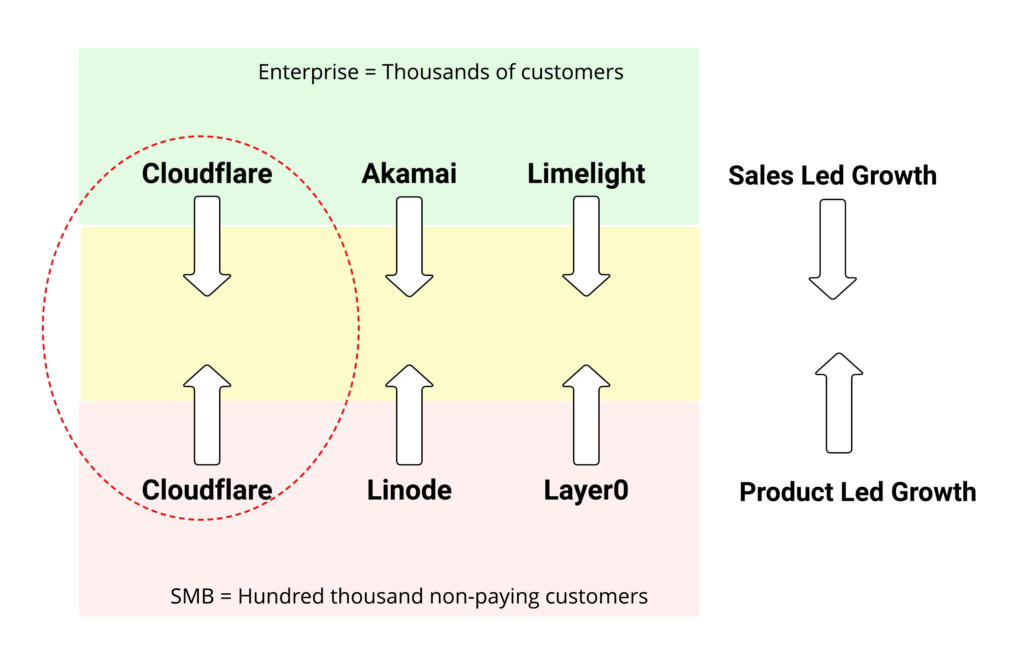

Another significant milestone in the acquisition that no one has talked about is PLG, also known as product-led growth. In the Layer0 acquisition, Limelight becomes a PLG company overnight. For that matter, so does Akamai with its Linode acquisition. Both CDNs have the platform to attract massive SMB subscribers, similar to Cloudflare.

The two core benefits of PLG are unlimited scalability and ease of use.

Unfortunately, no one has ever discussed the impact of PLG on the CDN industry. In the future, we’re going to throw the word PLG around.

Product-led Growth GTM

PLG, known as product-led growth, is a game-changer for the CDN industry. Eighteen months ago, we’d never even heard of the term PLG. Suffice to say; not many know what it is. In one sentence, it means freemium on steroids.

The more elaborate definition; it’s a focus, methodology, strategy, and philosophy for growing online businesses. PLG is a core theme for many successful companies like Datadog, HubSpot, Slack, and Atlassian

Openview is the official ambassador for PLG. They define it as a go-to-market strategy that “relies on product features and usage as their primary drivers of customer acquisition, retention, and expansion.”

Cloudflare is the Grandmaster of PLG in our industry. The last time we checked a few years ago, they had 4M+ non-paying subscribers. That means there is a large pool of warm leads waiting to be converted into a paying plan.

Just last year, Akamai and Limelight had no answer to PLG. Their growth engine was SLG, known as the sale-led growth model. In the SLG world, companies have large sales forces to sell products.

Layer0 and Linode

We’re going to include Akamai in this discussion to add context.

Linode and Layer0 provide the platform to transform Akamai and Limelight into hybrid PLG and SLG models. As a result, these two CDNs can sell solutions to the enterprise via SLG and use PLG to sell to SMBs. PLG is also used to sell to large enterprises that don’t want the help of a sales rep.

Cloudflare is doing this to perfection.

Cloudflare has the ideal SLG and PLG model under one roof. They have millions of free users. If a small percentage converts, there is a significant impact on the bottom line.

Limelight and Akamai now have a PLG platform to sign up hundreds of thousands of customers, even millions. The capability is there. Whether they execute it or have different plans, we don’t know.

One thing is for sure, Limelight and Akamai should leave the culture of those two companies in place. Instead of tearing them apart, invest in them like mad. In Limelight’s case, not only can they continue to grow their JAMStack revenue, but their platform enables them to sell more features at a low cost without disrupting the SLG model.

There is much to say about PLG, but we’ll do that in the future.

Disclaimer: I’m not giving investment advice or financial recommendations. We are not qualified to do so.