Beginning this quarter, we’ll publish a summary of the state of the CDN industry. The goal is to review specific topics and themes of the last quarter. Discussions around earnings, trends, market challenges, new product innovations, and industry competitiveness are up for grabs. We’re especially interested in transformative activities.

Akamai, Cloudflare, Edgio, and Fastly reported earnings in early August. Some themes that came up on the earning calls were the recession, products, and opportunities for growth. So let’s start with the recession.

Recession Impact

The question we have is whether the recession is having an impact on the CDN industry.

Akamai, Cloudflare, and Fastly spoke about a recession, and the message is there is one in some regions of the world. Europe is being hit much harder by inflation, skyrocketing energy costs, and the strong dollar. As a result, at least for Akamai, there has been a pullback on spending from media clients. Akamai’s delivery revenues are down 11%. However, their security and edge computing product lines continue to do well.

We looked at industries outside of the CDN market, such as traditional security, and there are issues with supply chains. However, this issue started with Covid. Palo Alto Networks, which sells appliances as well as subscriptions, went on record to disclose that 2022 was the most challenging period in its history. However, they mitigated the risk through proper planning.

Now we’ll answer the question. First, there is a recession in certain parts of the world. The National Bureau of Economic Research hasn’t called a recession yet in the US.

The recession is having an impact on content delivery revenues. We’ve seen this with Akamai. However, recession or no recession, delivery revenues have been under pressure every year for the last decade.

And content delivery is only one product in the CDN portfolio. Security and edge computing are the other two. The recession and economic turmoil are having no impact on the revenue of these two product lines.

We’ll even go on a limb and say that today’s economic hardship has not impacted the Four Horseman of Security. So let’s illustrate this below.

| Q1 2021 | Q2 2021 | Q3 2021 | Q4 2021 | Q1 2022 | Q2 2022 | |

|---|---|---|---|---|---|---|

| Akamai (Total) | $843M 10% y/y | $853M 7% y/y | $860M 9% y/y | $905M 7% y/y | $904M 7% y/y | $903M 6% y/y |

| Akamai (Security) | $310M 29% y/y | $325M 25% y/y | $335M 26% y/y | $365M 23% y/y | $382M 23% y/y | $381M 17% y/y |

| Cloudflare | $138M 51% y/y | $152M 53% y/y | $172M 51% y/y | $193.6M 54% y/y | $212M 54% y/y | $2345M 54% y/y |

| Fastly | $85M 35% y/y | $85M 14% y/y | $87M 23% y/y | $97.7M 18% y/y | $102.4M 21% y/y | $102.5M 21% y/y |

| Edgio | — | — | — | — | — | $74.3M 54% y/y |

| AWS | $13.5B 32% y/y | $14.8B 37% y/y | $16B 39% y/y | $17.8B 39.5% y/y | $18.4B 36.5% y/y | $19.7B 33% y/y |

| Palo Alto | $1.1B 24% Q3 2021 | $1.2B 28% y/y Q4 2021 | $1.2B 32% Q1 2022 | $1.3B 30% y/y Q2 2022 | $1.4B 29% y/y Q3 2022 | $1.6B 27% y/y Q4 2022 |

| Fortinet | $710M 23% y/y | $801M 30% y/y | $867M 33% y/y | $963.6M 29% y/y | $954M 34% y/y | $1.03B 29% y/y |

| Zscaler | $157M 55% y/y Q2 2021 | $176M 60% y/y Q3 2021 | $197M 57% y/y Q4 2021 | $230.5M 62% y/y Q1 2022 | $255.6M 63% y/y Q2 2022 | $286M 63% y/y Q3 2022 |

| Crowdstrike | $303M 70% y/y Q1 2022 | $338M 70% y/y Q2 2022 | $380M 63% y/y Q3 2022 | $431M 63% y/y Q4 2022 | $488M 61% y/y Q1 2023 | $512.7M to $516.8M Q2 Exp. |

The table provides quite the story. The most important takeaway is the four security vendors, and Cloudflare is performing as they were in regular times, which is quite well. However, Zscaler and Cloudflare are growing faster today than in the past.

Products

We’re interested in earnings because they reflect the strength of the product stack and growth model. Cloudflare has an innovative product stack with depth. So do Akamai and Edgio. And in many use cases, these vendors are the better choice for reducing costs. AWS and appliances that don’t scale can become expensive.

Cloudflare is growing +50% y-o-y every quarter because of the strength of its product stack and growth model. Akamai and Edgio are amid business model transformations. Having acquired Linode, Akamai is busy scaling its AWS-like compute stack to the world’s edge. Edgio, having acquired Layer0, is enabling the leading Jamstack platform across its global network. Both provide the tools to the developer community to build modern-day applications, microservices, and APIs.

Fastly, we wish we had something positive to say about their product stack. Fastly knows it, and so does everyone in the industry; it requires a significant transformation. Apart from the acquisition of Signal Sciences and the introduction of Compute@Edge, they’ve been silent.

And although Fastly has been growing the same this quarter as it has the last several quarters, there are warning signs that trouble is brewing in its growth model. One data point, among many, in Q2, they added 14 new customers.

Fastly can fix these problems with the proper acquisition. They certainly have the cash to do so.

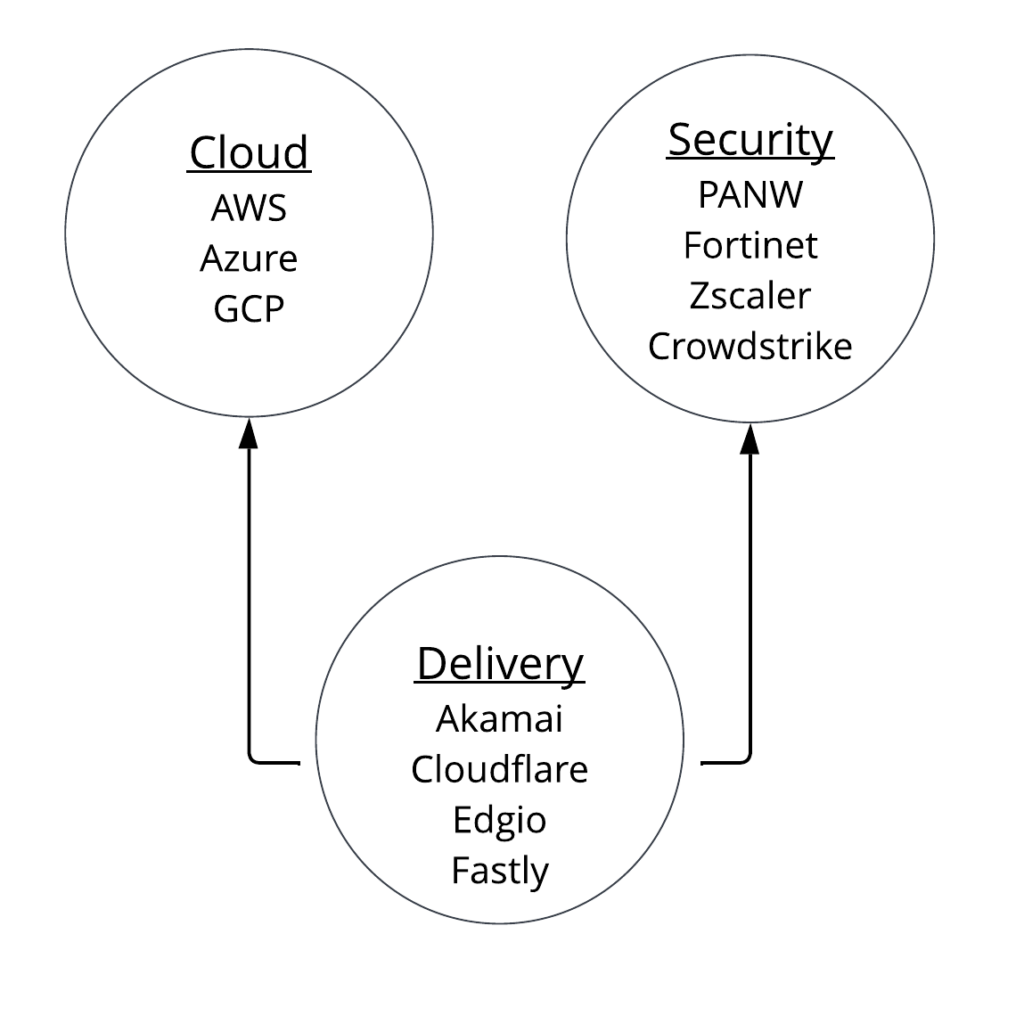

CDNs vs. AWS and The Four Horseman of Security

CDN’s fiercest competitors are the cloud giants and the traditional security industry. To narrow it down, the major competitors are AWS, PANW, Fortinet, and Zscaler. It’s industry knowledge that CDNs cannot grow market share by taking it from each other. So there isn’t enough to go around.

Instead, they need to capture market share from vendors in other ecosystems. Akamai and Cloudflare understand this and have said it countless times in public. Fastly hasn’t because they don’t have the product stack to do so, at least today. So what is the new reality?

Let’s stop here for now. We’ll say more in later posts.

Disclaimer: Bizety is not a registered legal, tax, or investment professional. All content is for informational purposes only. Therefore, we are not soliciting, recommending, or endorsing any public company or security.