Qwilt was born between the inception of Cloudflare and Fastly. Instead of becoming a traditional CDN, they opted to become a CDN for service providers, also known as network operators.

They have some indirect competition from the likes of Akamai, Edgio, Broadpeak, and to some degree, AWS Outpost and Wavelength, but the companies mentioned are not serious competitors.

- Akamai offers Network Operator solutions, but the revenue generated from this business is a blip and no longer reported. More importantly, the largest CDN is heavily vested in building its cloud computing capabilities and developer solutions.

- Edgio has Open Edge for ISPs, but their focus is on the developer community.

- Broadpeak describes itself as a company that “designs and manufacturers video delivery components for Content Providers and Network Service Providers.” Nothing more to be said.

- AWS Outpost extends its edge computing and infrastructure services to on-prem, but it is not an operator-specific solution.

- AWS Wavelength caters to the 5G and MEC ecosystem but lives in the shadows of Sylva, the open-source telco cloud project now under the Linux Foundation and backed by Europe’s largest carriers. Wavelength isn’t popular among telcos due to location and latency issues. Also, it’s not a CDN solution.

Regarding CDN operator solutions, Qwilt is on an island by itself, and on top of that, they offer their software free of charge, making money through revenue share.

Transparent Caching

Who is Qwilt? In the beginning, Qwilt described itself as a transparent caching platform.

The words transparent caching are no longer relevant, as it is an old-school concept replaced by the edge. Instead, the edge encompasses computing, storage, security, and delivery, not just caching.

The only direct competitor in the last decade ago was PeerApp. PeerApp was founded in 2004 and pioneered the transparent caching segment, but it got acquired in July 2018.

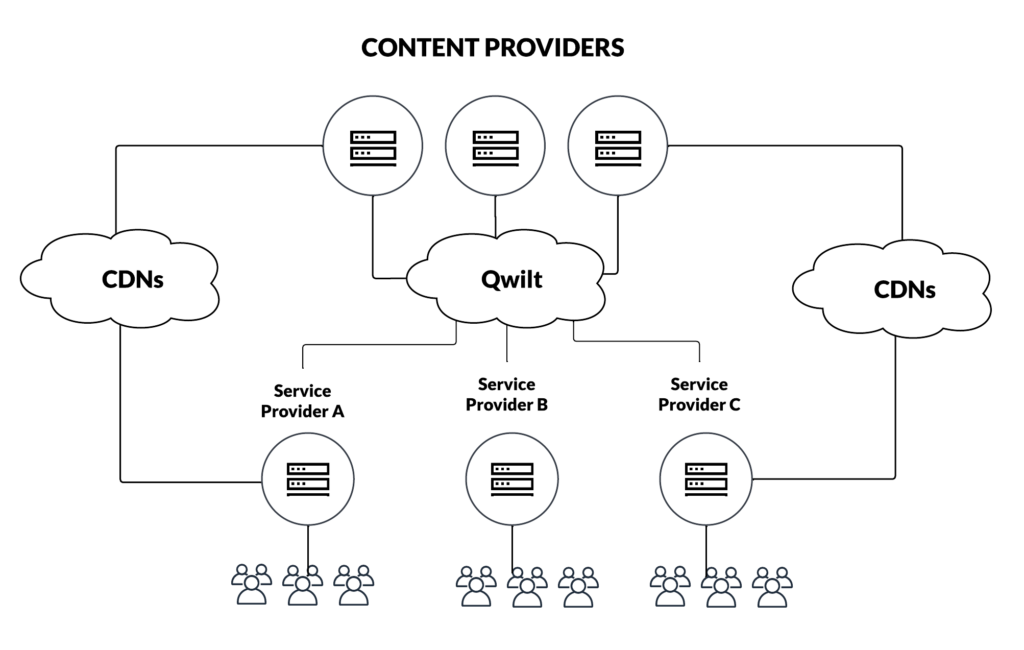

Today, Qwilt describes itself as The Open Edge Cloud. The company is laser-focused on content and service providers, seeking to attract the top content and service providers worldwide to its platform.

So far, Qwilt has been successful. Some notable customers include the following:

- Customers: Airtel, Vodafone, BT, and Verizon.

- Verizon is running Qwilt on 600 nodes.

- 3 of the 5 top ISPs in Brazil are Qwilt customers.

- The non-profit organization NCTC (National Content and Technology Cooperative), a community of 750+ broadband operators, signed up with Qwilt to help provide higher-quality streaming and capacity to 34M households.

Federated CDN

Although Qwilt is many things, the one that stands out most is the Federated CDN. The concept of Federated CDN is as old as Akamai, and a pie-in-sky idea we believed would never work, but we were proven wrong.

Some brave companies tried to make Federated CDN a reality, but they fizzled out. Edge Gravity had big ambitions to conquer the world with a Federated CDN model, and they had the backing of a billion-dollar company, but the challenge proved too much. However, they made solid progress in signing 80 broadband providers.

Is Qwilt the only successful Federated CDN business model in the last decade and possibly ever? It sure sounds like it.

We have learned much about the Federated CDN model from Qwilt and Edge Gravity.

It’s not money, brains, or the backing of a billion-dollar company that makes a difference in building a Federated CDN. The key to building a Federated CDN model is perseverance. Edge Gravity did not have time on its side. Qwilt has been doing this for over a decade.

Qwilt has yet to conquer the CDN operator market by any stretch of the imagination. If we were to guess how far they have gone in their journey, we’d say they are 10% there. So they are in the long game, and it will take many more years to conquer this segment.

The good news, they have all the pieces in place, the software stack, reference customers, experience, knowledge, and patience.

Once Qwilt signs up hundreds of content providers and hundreds of service providers, they will be a force to be reckoned with in the CDN carrier edge industry. They will likely be a counterbalance to the entire infra-CDN segment and AWS. Service providers can look forward to that since they get paid a share of the revenue pie.

Although Qwilt enables service providers to build CDN capabilities just a few miles away from broadband users, the bigger story is edge computing. Once Qwilt signs up enough edge carriers in hundreds of locations, it’ll be on its way to becoming the largest footprint of edge computing nodes in the last-mile networks globally.