Limelight Networks (LLNW) is at a crossroads, and if they seize the opportunity in front of them, they will flourish. If not, they will be in the same bucket as Internap. Just about every CDN in the ecosystem, big and small, has a better CDN platform than Internap. However, to Internap’s advantage, it doesn’t really matter much, because they have a thriving hosting and managed services business that keeps them humming along. Not so for LLNW. All it has is the CDN business and nothing else. The CDN business is an innovation driven business, and we haven’t see any “wow” type innovation from LLNW in a long while. What happens to LLNW if they run their business as usual for the next 12 months? It’s going to see its market share erode even further.

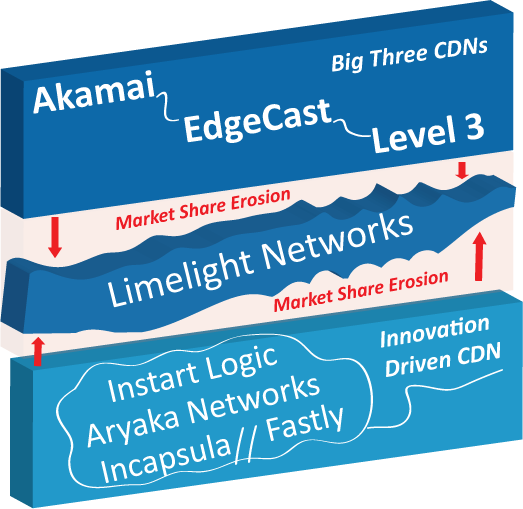

Limelight Networks is in a tough spot. They are right in the in the middle of all the CDN players, getting sandwiched by the big three CDNs at the top, and the innovation driven CDNs at the bottom. The Big Three CDNs (Akamai, EdgeCast, Level 3) have more scale, money and capitalization. The innovation driven CDNs are more creative, and offer better features. Both groups are taking market share away from LLNW. On the bright side, LLNW has a finely tuned sales force with years of experience selling CDN services. The only thing missing is a great product line that’s different from the competition, and performance doesn’t count. We are past the half year mark, let’s see if LLNW has a surprise in store for the industry. My guess is that by year end, LLNW will surprise the industry and acquire a game changing start-up that in turn changes the LLNW business model for the better. Here is what LLNW looks like the in the ecosystem.

Crunch Time For Limelight Networks