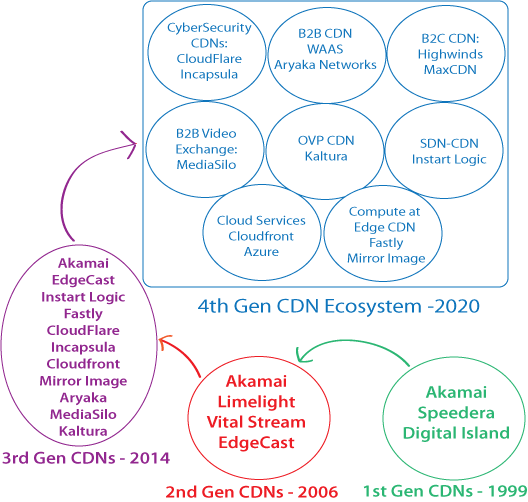

In the next couple of posts, we’ll try to determine what the CDN Ecosystem will look like in 2020. Before we do that, let’s quickly review CDN history, noting that the past is sometimes a good indicator of the future, especially when it comes to the formation of new CDN business models. Although CDNs started in the mid-to-late 1990’s, the pure-play CDN industry took a big step forward with the entrance of Digital Island, Akamai and Speedera.

In a relatively short time span, they invented a lot of delivery techniques, and filed dozens of patents, many of which are still in use today. Fast forward a few years, and Limelight Networks enters the picture, and becomes the 2nd largest CDN, while Vital Stream struggles to scale, but successfully sells to Internap. At the same time, EdgeCas starts as a CDN, and the 2nd CDN Generation begins, welcoming new players, like Amazon Cloudfront and Cotendo.

Four CDN Generations

| 1st Gen | 1999 | Akamai, Digital Island, Speedera | Basic small file delivery, then large file delivery, limited feature set and reporting |

| 2nd Gen | 2006 | Akamai, Limelight, Vital Stream, EdgeCast | Large file and small file delivery, live streaming, VOD, basic feature set and advanced reporting |

| 3rd Gen | 2014 | Akamai, EdgeCast, Instart Logic, CloudFlare, Fastly, Incapsula, Aryaka, Mirror Image, Kaltura, MediaSilo | WAF, FEO, DSA, ADN, DDoS, Software Defined App Delivery, HLS, HDS and advanced analytics, log streaming, real time purging, real caching, app logic at edge |

| 4th Gen | 2020 | CyberSecurity CDNs, B2B CDNs, B2B Content Exchange CDNs, OVP CDNs, CDN Edge-compute-as-a-CDN | SDN-CDN, CDN Edge-compute-as-a-server, Security L3-7, ecosystem of real times services: compute, reporting, caching, etc |

CDN Ecosystem HistoGraph

3rd Generation CDNs

The 3rd Generation CDN era started around 2012, and is now in its prime. This era is defined by the CDN Specialist that excels in offering a premium niche service leveraging CDN infrustructure. These CDNs excel in security (CloudFlare), Software Defined Application Delivery (Instart Logic), CDN Edge-compute-as-a-service (Mirror Image), and so on. The 3rd Generation CDN Ecosystem take a big leap forward from the prior one, because of the new CDN customers that include the likes of Snapchat, WhatsApp, Facebook, Yelp, LinkedIn, Twitch, Netflix, Twitter, Salesforce, Workday, Imgur, and so on.

The arrival of these large cloud based Internet companies have dramatically altered the CDN landscape, exploding the CDN market potential. The CDN industry of today is vastly different, more sophisticated, and larger than the one in 2007. What is the market size potential of the CDN industry of 2020? It’s very difficult to say, but its going to be in the tens of billions of dollars, because CDN players are beginning to collapse other non-CDN industries into its fold, like hardware appliance based security (f5), MPLS, professional filmmaking in the cloud, and so on. Continued in the next post.