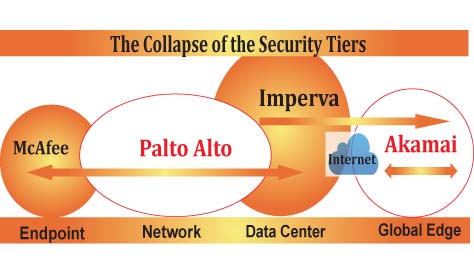

Palo Alto Networks (PAN), the founder and leader of the next generation firewall appliance is growing up fast. It graduated from the hardware appliance market a while back when they introduced the Wildfire, a cloud based service for mitigating APT, zero-day and malware. Now with two acquisitions under its belt, PAN is expanding horizontally across to the different security tiers, in order to offer an end-to-end security solution.

Palo Alto Networks

The recent Cyvera acquisition puts PAN into the endpoint security game. With Cyvera, Morta Security, and Wildfire under wraps, PAN is posing a threat to the security endpoint players, and data center security kingpin Imperva. PAN has a long way go before it becomes a contender in the of end-to-end security game, but the ball is in motion. It’s only a matter of time before the competition starts to encounter them in deals.

Palo Alto Network Facts

- 16,000 Customers

- 65 of Fortune 100

- 1,375 Employees

- Adding 1,000 customers per quarter for last 9 quarters

PAN really gets the security business. End-to-end security working from one dashboard is a power story. However, for the end-to-end story to become a reality, PAN must extend the business model to the global edge, beyond the cloud, where CDNs reign supreme. That’s what Imperva did. If PAN acquired a CDN, it would disrupt the CDN market immediately, and also threaten Akamai’s ecommerce business. Will PAN acquire a CDN? Time will tell.

Imperva and Akamai

Imperva is also moving at the speed of light with its recent acquisitions of Incapsula and Skyfence. Imperva gets it. They understand that the hardware appliance business will eventually take a back seat to cloud security services. Out of all the companies in the technology infrastructure business, Imperva has made the boldest move when it acquired Incapsula, officially entering the CDN business, and making a play in the already competitive market. The question for Imperva is will it expand into the network security tier, where it will compete head to head with PAN.

Akamai, with its acquisition of Prolexic, deepends its DDoS business portfolio. Akamai is bigger than Palo Alto and Imperva combined. However, probably not for long. Akamai is the kingpin of DDoS protection. No company can ever challenge them, including Level 3. However, Akamai stops at DDoS. If Akamai’s plan is to do with security what it has done with CDN, it will need to acquire a security company that crosses into a different security tier. With $1B in cash, they can easily do so. The entire world is waiting for their next move, including myself. Ultimately, PAN, Imperva and Akamai are going to collide into each other sooner or later. When that happens, the most innovative company is going to win the day.