Akamai continues to lead our market in revenue, the number of enterprise customers, network capacity, PoPs, server count, headcount, acquisitions, etc. Although its narrow focus on the CDN industry helped it dominate the market, it also missed the chance to become AWS.

The industry is changing, though. New competitors have emerged. If Akamai and Cloudflare continue to grow at current rates, Cloudflare will overtake Akamai in revenue in a few short years.

The burning question we have is Linode the company to transform Akamai’s fortune? They need significant YoY growth, not 7%.

Interview with COO

Context is needed; therefore, we’ll dissect two different sources, an interview, and an earnings call.

In early April, Adam Karon spoke to Techcrunch about why they bought Linode. It is the most interesting piece to come out of Akamai in years. A few key takeaways from the interview:

- Akamai acknowledges having missed the computing wave

- Akamai was the destroyer of cultures. Once they bought a company, they integrated it into the Akamai machine

- Akamai will treat the Linode acquisition differently, keeping the Linode culture in place

- Apple asked Akamai about running VMs and containers on the network

- Akamai has the platform in place to support VMs and containers at the edge

- Building a full-fledge compute platform would have taken time, so they acquired Linode to speed up the process

- The plan is to become more developer-centric

Also, Adam stated that “Akamai doesn’t want to build, though, is another AWS. You should hang up on me right now if I said that.” Almost two weeks later, Akamai announced the introduction of Managed Database (DBaaS) with the support of PostgreSQL, MySQL, and MongoDB.

Introducing DBaaS is about the most AWS thing you could do.

2021 Earnings

On the earnings call, Akamai spoke about its plans with Linode. Here are the highlights.

- Q4 revenue was $905M, 7% YoY

- 2021 revenue was $3.46B, 8% YoY

- 2021 free cash flow was $859M (important when making acquisitions)

- Q4 security revenue was $365M, 23% YoY

- 2021 Security revenue was $1.33B, 26% YoY, representing 39% of revenue

- Q4 international revenue was 47% of total revenue

- Bot Manager and WAF “posted excellent results in Q4,” but they don’t mention how much.

- CDN business was $541M, down 2% YoY

- Traffic peaked at 200 Tbps in the quarter

- Edge Application run rate was $200M, growing at 30% in the year

- For 20 years, they have been a leader in edge computing

- The new theme is “build, run, and secure.”

- Linode has four product lines: compute, storage, orchestration, and developer tools.

- Upon acquisition closure, there will be five product groupings. More below.

- Akamai has an experienced global workforce and channel program to help sell Linode to their enterprise clients.

- Q4 Guardicore (acquisition) revenue was $10M.

- Linode will add $100M in 2022 if it closes in Q1 2022

- Financial reporting will change from 1) Security Technology Group and 2) Edge Technology Group to 1) Security, 2) Delivery and 3) Compute

- Q4 Net Storage revenue was $57M

- Top 10 customers contribute 1% of revenue or more

- Expected Q1 2022 revenue of $896M to $910M, up 6% to 8% YoY

- Expected 2022 revenue of $3.673B to $3.782B, up 6% to 8% YoY

- Linode was growing 15% annually, pre-acquisition

- Compute segment expected to grow 30% to 35%

- 2022 expected Guardicore revenue to be $30M to $35M

The key takeaway from the earnings call is its plan for Linode and the new grouping of technology products.

Here is Akamai’s growth over the last six years.

| Year | Revenue | YoY Growth |

|---|---|---|

| 2021 | $3.5B | 8% |

| 2020 | $3.2B | 11% |

| 2019 | $2.89B | 7% |

| 2018 | $2.7B | 9% |

| 2017 | $2.5B | 7% |

| 2016 | $2.3B | 6% |

When it comes to acquisitions in our industry, Akamai is the best. They can buy a startup that does $10M ARR and ramp it to $100M in a few years without a problem. They can buy any revenue stream and magnify it by multiples due to the sheer size of their global salesforce and strong channel program.

Here is the problem. For whatever reason, acquisitions don’t help Akamai grow beyond 7% to 9% YoY.

Cloudflare is growing at 52% YoY. In 2022, Cloudflare will get close to $1B in revenue. In a few years, they will become the #1 CDN in revenue. If AWS can grow at 37% (Q1 2021), then Cloudflare can grow at 50%.

Is Linode the company to transform Akamai’s fortune?

Akamai Technology Stack

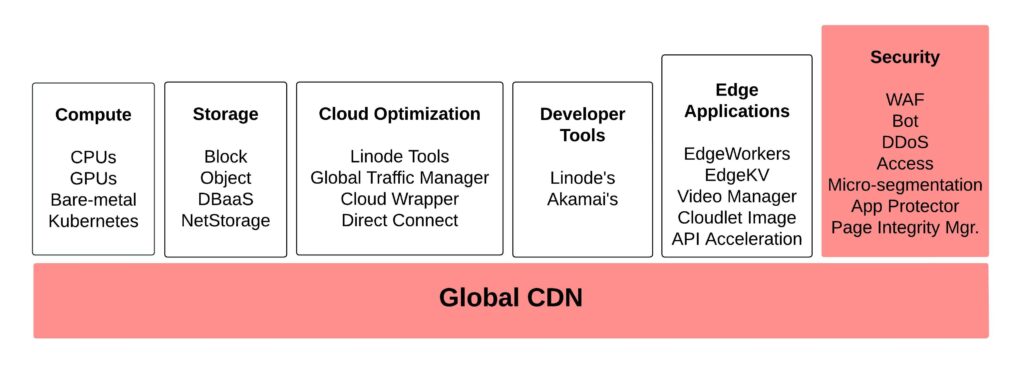

Adam Karon, the COO, spoke during the earnings call and broke down the new technology stack grouping post-Linode acquisition. There will be five groupings; however, did he forget security? We’re going to fill in the blanks and put security in there.

The product groupings should not be confused with the two groups used for financial reporting purposes; Security Technology Group and Edge Technology Group.

The diagram illustrates Akamai’s technology stack after the Linode acquisition closes.

Linode’s Role

Furthermore, on the earnings call, CEO Tom Leighton stated the following:

The primary objective is to take Linode and really scale that up and sell it into the large enterprise base. I think that’s far more lucrative for us than taking our existing solutions and selling into the large number of small customers. And the focus will be moving Linode’s capabilities into our platform and having a comprehensive solution for large enterprise customers.

2021 Q4 Earnings Call

Two months later, COO Adam Karon noted during an interview:

Akamai will likely want to be able to offer non-enterprise customers on Linode the ability to buy CDN capabilities. It already built some of these capabilities when it launched its click-to-buy CDN solution for Azure a few years ago. 2) The overall idea here, though, is to keep Linode’s culture intact in the process of merging the two businesses. 3) We’re going to inject Akamai into Linode, as opposed to putting Linode inside Akamai. 4) They’re choosing the developer over the enterprise and the world is shifting to where the enterprise is becoming the developer. And we see that so we want to shift to the developer as our primary customer without losing our enterprise focus.

Techcrunch

Akamai’s Transformation

The two different viewpoints point to a lack of clarity on the Linode strategy. Since Adam spoke after Tom, we’ll take this as Akamai’s latest position.

The Akamai-Linode integration will take some time to complete. In the meantime, the C Levels must make the right decisions today.

All the right pieces for an Akamai transformation are in place.

- AWS-like technology stack

- Global salesforce

- Strong channel program

- Experience in scaling platforms

- Experience integrating companies

Akamai should take the Linode platform to its enterprise customers.

Just as important, Akamai should invest the resources to build Linode’s “1MM customers worldwide” to five million or ten. Throw in a free tier to grow the audience to Cloudflare-like levels. If Akamai takes the path Tom mentioned, we can expect Akamai to grow 7% – 9% YoY.

If they invest in PLG, converting free subscribers to paying ones will impact the bottom line, Cloudflare-style.